India has made significant strides in fostering entrepreneurship and expanding financial inclusion. However, a crucial demographic remains on the periphery of these achievements — rural women entrepreneurs. India needs to assign a specific priority sector tag to women-led rural enterprises to facilitate easier access to credit, says a recent World Bank paper. Such an initiative could boost female labour force participation and drive economic growth in rural areas, it says.

While microenterprise financing falls under the priority sector lending guidelines, these loans predominantly target enterprises at the upper end of the spectrum, closer to the ₹5 crore turnover mark. Smaller, women-owned rural enterprises often struggle to secure necessary funding. By creating a sub-segment within the microenterprise category specifically for growth-oriented, women-led enterprises, commercial banks can be encouraged to extend credit to these businesses, thereby fostering their development and sustainability.

READ I Green hydrogen: Big vs small debate heats up amid de-carbonisation race

Gender gap in entrepreneurship

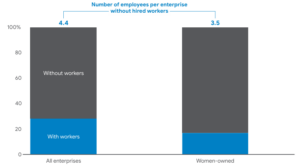

Another significant advantage of assigning priority sector tag to women-led rural enterprises is bridging the gender gap in entrepreneurship. Women are vastly underrepresented in the entrepreneurial ecosystem. Targeted financial support can empower more women to start and grow their businesses, thereby fostering a more inclusive and balanced economic landscape. This move can also serve as a powerful statement of India’s commitment to gender equality and women’s empowerment, aligning with global development goals.

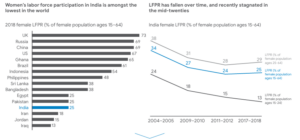

One of the most pressing issues that the priority sector tag could address is the declining female labour force participation in rural India. Women-owned growth enterprises have the potential to generate employment opportunities, not only for their owners but also for other women in their communities. This multiplier effect is crucial in regions where traditional employment opportunities are scarce. By supporting these enterprises, India can take a significant step towards reversing the downward trend in FLFP.

Women-led rural enterprises key to social mobility

By focusing on women-led rural enterprises, India can also enhance social mobility and reduce poverty in rural areas. Women entrepreneurs often reinvest their earnings into their families and communities, improving health, education, and overall living standards. Supporting these businesses can therefore have far-reaching social benefits, contributing to the broader goals of poverty alleviation and social development. Moreover, as these enterprises grow, they create a ripple effect, inspiring more women to pursue entrepreneurial ventures and fostering a culture of innovation and self-reliance.

Introducing growth-oriented women’s enterprises to commercial loans can also help establish their creditworthiness for future financial interactions. The World Bank study recommends investments in digital bookkeeping and payment solutions to track enterprise cash flows. These digital tools can provide a transparent and accurate record of financial activities, which is vital for developing customised financing products. Moreover, by adopting such digital solutions, enterprises can meet sector-specific benchmarks and receive tailored support services.

Learning from global best practices

India can draw valuable lessons from international best practices in supporting women entrepreneurs. For instance, countries like Bangladesh have successfully implemented microfinance programmes that specifically target women, leading to significant economic and social improvements. Similarly, countries in Africa have developed innovative digital solutions to facilitate access to credit for women entrepreneurs. By adapting and implementing these proven strategies, India can create a robust support system for rural women-led enterprises, ensuring their long-term success and sustainability.

The World Bank study calls for comprehensive institutional reforms to bolster women-led rural enterprises. Strengthening decentralised incubation centres, developing women entrepreneur associations, and enhancing institutional procurement avenues are essential measures. These reforms can provide the targeted support and resources needed for women-led enterprises to thrive and contribute significantly to job creation and income generation.

Public-private partnerships

Public-private partnerships can play a crucial role in supporting women-led rural enterprises. Collaboration between government agencies, financial institutions, and private sector companies can lead to the development of tailored financial products, mentorship programs, and market access initiatives. These partnerships can leverage the strengths of each sector to provide comprehensive support to women entrepreneurs, addressing their unique challenges and helping them scale their businesses. By fostering such collaborations, India can create a more enabling environment for women-led enterprises to thrive.

The potential impact of granting priority sector lending status to women-led enterprises cannot be overstated. According to Rituparna Chakraborty, co-founder of Teamlease Services, such initiatives are far more impactful than traditional employment schemes like MGNREGA in enhancing job opportunities for women. By focusing on growth-oriented enterprises rather than subsistence-level businesses, the Indian economy can benefit from more sustainable and long-term economic development.

To ensure the effectiveness of the priority sector lending initiative, robust monitoring and evaluation mechanisms must be put in place. Regular assessments of the program’s impact on women-led enterprises can provide valuable insights into what is working and what needs improvement. This data-driven approach can help refine policies and interventions, ensuring that they are responsive to the evolving needs of women entrepreneurs. Additionally, transparent reporting and accountability can build trust among stakeholders, encouraging more women to participate in the entrepreneurial ecosystem.

In conclusion, granting priority sector status to women-led rural enterprises is not just a matter of financial inclusion; it is a strategic move to stimulate economic growth and improve the socio-economic status of rural women. By addressing the specific needs of these enterprises, India can harness the untapped potential of half its population, driving progress and prosperity for the entire nation. The insights from the World Bank studies provide a clear roadmap for this transformation, emphasising the need for targeted credit access, digital integration, and robust support structures. It is time for India to recognise and act on this imperative, paving the way for a more inclusive and dynamic economy.