Cradle-to-grave social security is the hallmark of developed societies. Pension is an important component of social security. This is not the case with developing countries like India where pension is a privilege enjoyed by government employees and public sector staff. This article discusses various facets of the pension system in developed societies and argues that the universal pension system modelled on western countries is the answer to many of the problems faced by the Indian economy and society.

Though the pension systems of developed countries differ in details, some common elements can be observed. It is part of a comprehensive social security system. The pension systems of all countries encourage citizens to work and save for old age during their productive years. There are laws making it mandatory for everyone working in both private and public sector to join pension funds and make contributions. Those who want more pension post retirement have to make larger contributions to the pension funds during their working years. This system is known as pay-as-you-go (PAYG).

READ I Labour reforms: How labour codes gave social dialogue, consultations a miss

A noteworthy feature of the pension systems in developed countries is that it ensures a minimum guaranteed pension to all citizens. Going by their contribution, a citizen may not be eligible for guaranteed minimum pension or may be eligible for a lower pension. The pension system ensures that such citizens also receive minimum guaranteed pension. The required resources are mobilised through general taxes. The tax-GDP ratio in most developed countries hovers around 35%. It is this high taxation that ensures guaranteed minimum pension to all citizens. The system carries with it a fair degree of redistributive element.

The pension systems of developed countries have undergone major changes in recent years. Citizens are given the option of joining private or public pension funds. Pensions are susceptible to fluctuations as pension funds invest in stock market. Citizens are given the option of selecting defined pension schemes to protect themselves from such fluctuations. Government support is available for pension funds to tide over fluctuations in the stock market.

India’s statutory pension system

India inherited the statutory pension system from colonial rulers. At the time of Independence, statutory pension was not a big burden on the exchequer for several reasons. The bureaucracy was lean with modest salaries and allowances. Deducting from the salary for pension payment would have resulted in further reduction in the take-home salaries of government employees. The life expectancy at birth as per 1951 census was just 32 years. That means many would have passed away while in service. Those who retired would have lived for maybe another five or ten years.

This changed in subsequent years. The size of the bureaucracy increased by leaps and bounds. Unionised bureaucracy at the Union and state levels relentlessly lobbied for higher salaries and perks. Over the years life expectancy increased from 32 years to 70 years. This has resulted in a situation of paying half the salary with dearness allowance and periodic revision to government employees who drew salary for 30 years as pension for another 30-40 years.

Over the years, statutory pension has become unsustainable and the Government of India took the landmark decision to move over to contributory pension. National Pension System (NPS) was introduced in 2004. Newly employees in central and state governments were recruited under the NPS.

READ I Budget 2022: Optimism of policy makers may be misplaced

Pension burden on government finances

The introduction of contributory pension has only limited the impact on the pension burdens of the central and state governments. This is because the employees recruited till 2003 continue under statutory pension. Assuming that they retire after 30 years, and continue to live for another 30 years, the pension burden of the government will remain unabated till the 2060s. While the Union government is fiscally better placed to meet this commitment with its vast resources, most state governments are reeling under the fiscal stress.

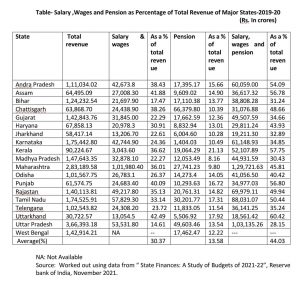

Kerala, with its unique development model, has attracted worldwide attention. It is an undeniable fact that government employees in the health and education sectors have played a vital role in making Kerala the way it is now. However, in the face of inadequate revenue growth, the state is finding it difficult to maintain its achievements in physical quality of life and human development. As per figures in 2019-20, Kerala is second among major states in terms of expenditure on salary and pension as a percentage of total revenue.

Kerala spends 57.75% of its total revenue on salary and pensions. This means that 57.75% of revenue goes to of just 4% of the population. The pension expenditure of Kerala is significantly higher than that of 19 major states. While Kerala spent 21.13% of total revenue for pensions, the average for 19 major states is only 13.58%.

Salary and pensions are committed items of expenditure. After meeting the committed expenditure, the resources available for non-committed expenditure has been consistently coming down. A comparison of welfare pensions and statutory pensions will make this point clearer. Kerala was the first state to introduce welfare pensions for farm workers in 1980. The difference between welfare pension and the statutory pension of an additional secretary in the government secretariat was 20 times then. Now, in 2022, this difference has widened to 50 times.

READ I Out of coverage: Labour Codes must ensure basic rights to gig and platform workers

Universal pension: The way forward

It is high time the country moved over to a comprehensive system of universal pension. Now senior citizens are covered by three systems of pensions — statutory and contributory pensions to government employees and old age pensions to ordinary citizens. Wide differences exist between these three. The pension burden of Union and state governments can be substantially brought down by bringing the statutory pensioners under the contributory pension system. There is a misconception that this is not possible as pensions are deferred salary.

The supporters of statutory pension often cite some Supreme Court judgements. The meaning and purport of the Supreme Court judgement is that pension is something to be paid out of the salary earned by an employee. Viewed from that angle, statutory pensions are not pensions per se but are a form of salary itself. It carries with it dearness allowances and periodic revisions. Assuming that it is a deferred salary, current revenue is used to pay pensions to those who retired years back. It is a classic example of how societies can get trapped in inappropriate or wrong choices made at a point in its history.

Statutory pensioners can easily be brought under the contributory pension system by notionally working out the pension they would have been eligible for had they been under a contributory system. This will substantially reduce the pension burden of the Union and state governments. The resources thus saved can be used to raise the old age pensions of ordinary people.

The Centre could also pass a legislation making it mandatory for all working people to join NPS or private pension funds and start making contributions. Alternatively, the states may be given the freedom to form their own pension funds by setting apart a portion of the revenue and also by monetising a portion of public assets.

Universal pension will be a game changer for India. The statutory pension as it exists today does not promote economic activity. A vast majority of statutory pensioners have non-pension income. As a result, only a small portion of the pension reaches the market. The pensioners in general have low propensity to consume. A significant portion of the pensions is parked in fixed deposits and share market products.

The propensity to consume of ordinary people is quite high. Increased pensions will directly flow to the local market and rejuvenate economic activity. The multiplier effect will lead to a virtuous circle of growth. The social effect of universal pension is even more significant. The realisation that one will be eligible for pension at old age will motivate people to work hard and save. This will substantially enhance their esteem in their families and society and the tendency of treating old people as liabilities will cease.

(Dr Jose Sebastian retired as senior faculty of Gulati Institute of Finance and Taxation, Thiruvananthapuram.)