India’s climate finance conundrum: Greenhouse gas concentrations are rising, leading to increased global surface temperatures, and continued economic and biodiversity losses. The last decade, 2011-2020, was the warmest on record, with each decade since the 1980s being warmer than the previous one. The Intergovernmental Panel on Climate Change estimates that the average global temperature increased by 0.85°C between 1880 and 2012, with a projected 1.5°C increase compared with pre-industrial levels likely by 2040.

India, as the most populous nation, has a crucial role in global climate action. Its efforts are vital for reducing emissions and improving the local environment. Addressing climate change is essential for India to combat extreme weather and minimise losses. Exposure to higher temperatures and the resulting reduction of working hours led to substantial income losses in services, manufacturing, agriculture, and construction in India, amounting to 5.4% of GDP in 2021. Additionally, India is among the countries most vulnerable to climate change, facing some of the highest disaster risk levels in the world, ranked 29 out of 191 countries (Inform Risk Index, 2019), with 80% of the population residing in districts highly vulnerable to extreme hydro-meteorological disasters (floods, droughts, cyclones).

Climate change, through its impact on various industries, has also increased risks to financial stability. Physical and transition risk drivers from climate events reduce a borrower’s capacity to service or repay debt, becoming a credit risk for banks. This poses a high-risk scenario, given that India is classified as the most vulnerable to climate-induced physical risks among BRICS countries and major advanced economies (AEs) by the IMF.

READ I FDI policy: Imperatives for India’s economic transformation

Need for climate finance

Addressing climate change necessitates substantial funding. Green financing requirements in India are estimated to be at least 2.5% of GDP per annum to address the infrastructure gap caused by climate events. India’s current clean energy investment stands at $17 billion in 2022. However, an estimated $50-100 billion per year incremental investment is required. These costs will entail asset build-up costs of green transition in electricity, industries, and transportation, which are estimated at over $10.1 trillion, with a deficit of $3.5 trillion funding beyond known capital sources. Furthermore, reducing dependence on fossil fuels to meet climate goals will lead to substantial revenue losses, increasing the burden on the exchequer.

Fossil fuels — coal, oil, and gas — together account for almost 19% of the total revenue receipts of the Union government. Also, the average thermal aging fleet is younger in emerging economies compared to developed nations, which may result in higher stranded costs. As India reduces its reliance on fossil fuels in its energy mix, tax revenue from these sources will decrease. Consequently, India will require increased funding for transitioning to green alternatives.

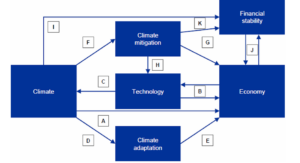

Linkages between climate and economy

The deficit in resources needs to be mobilised both internationally and domestically. India faces a funding gap for its ambitious climate goals, despite strong arguments for grants. With a minimal historical emissions footprint (only 4% globally between 1850 and 2019) and high rankings in climate action (CCPI 2023), India qualifies as a top candidate for grants from developed nations and multilateral organisations to achieve its ambitious net-zero emissions target by 2070.

The principle of “common but differentiated responsibility” highlights the obligation of developed nations, with significantly higher historical emissions, to offer financial aid. Securing these grants, alongside domestic efforts, is vital for India’s sustainable future. Therefore, India must intensify its efforts to secure grants based on its low emissions and strong performance. India has called for developed countries to provide at least $1 trillion per year from 2025, composed primarily of grants and concessional finance.

Without adequate grants, international borrowing becomes an alternative for climate change funding. However, relying solely on foreign capital can destabilise the balance of payments, impacting the current account deficit. This overreliance poses risks, including vulnerability to events such as rising global interest rates, which can destabilise economic stability, affecting exchange rates, sovereign ratings, and domestic monetary policy.

Additionally, the burden of repaying foreign debt diverts resources from crucial domestic priorities in the future. To achieve its climate goals, India requires a more sustainable approach. This involves mobilising domestic resources, attracting strategic foreign direct investment that fosters green technologies, and seeking multilateral support through concessional loans and technical assistance. By diversifying its funding sources, India can chart a more resilient path toward a sustainable future.

While tapping into domestic savings is the easiest mechanism to finance the green transition, India, being a developing nation, needs to prioritise growth and development priorities as well. Channeling existing domestic savings toward green transition projects reduces available funds for infrastructure and other social sector priorities. Therefore, the government must focus on raising domestic savings to enhance funds available for climate preservation.

Moreover, mobilising domestic resources in India poses challenges due to restricted bond market access and fluctuating foreign involvement. The corporate bond market in India, constituting 16% of GDP, pales in comparison to Korea’s over 80%. Similarly, China and Malaysia maintain significantly higher levels of corporate debt as a percentage of GDP compared to India. Consequently, expanding the overall pool of domestic savings becomes essential. The following are strategies through which India can boost the availability of domestic resources to finance green transition projects.

Expanding domestic financing capabilities

Fintech inclusion bolstering savings: By empowering more people to save and participate financially, fintech can unlock national savings crucial for financing India’s green future. Mobile banking and wallets are bringing millions into the financial system, mirroring the rise in the financial inclusion rate from 25% in 2008 to over 80% of adults in 2023. Building on this momentum, a new system facilitating low-cost, real-time payments can further incentivise saving by minimising transaction fees and making saving a seamless experience.

Increasing government savings: To enhance fiscal capacity for addressing climate change, India can strategically boost savings by disinvesting non-core assets, cutting unproductive public spending like freebies, and improving expenditure efficiency. This approach aims to reduce the fiscal deficit, crucial for bolstering domestic savings and decreasing government borrowing. For instance, in 2022-23, 59 loss-making public sector enterprises reported a combined net loss of ₹4,811.73 crore, underscoring the potential for substantial resource reallocation. Such measures pave the way for issuing green bonds, vital for financing sustainable initiatives and achieving environmental goals effectively.

Pension reforms: Pension reforms in India hold the potential to significantly boost national savings and unlock resources crucial for tackling climate change. Despite growing subscribers, the system needs deeper penetration, especially among informal sector workers. Reforms could integrate informal savings like chit funds into regulated pension systems like the National Pension System (NPS), tapping into substantial savings potential. Additionally, increasing tax incentives specifically for pension contributions would encourage individuals to save more. Furthermore, the NPS itself can be revamped to offer greater investment autonomy and a “clean tech tier” with higher returns focused on sustainable projects.

Consumption taxes: To leverage consumption tax reforms for climate action in India, a two-pronged approach is essential. First, simplify the tax system and potentially lower overall tax burdens to boost disposable income for savings. Second, implement higher consumption taxes on carbon-emitting products, environmentally harmful items, and demerit goods like cigarettes. This discourages their consumption, promotes greener alternatives, and generates revenue for climate initiatives. Recycling carbon revenues can finance climate change. A crucial component is raising India’s carbon tax, currently one of the world’s lowest at $1.6 per tonne of CO2, to achieve a targeted 33-35% reduction in emissions by making polluting activities more expensive and incentivising cleaner alternatives.

The urgency of green financing highlights the need for sustainable energy and infrastructure. International support, including grants and concessional finance, is crucial to balance funding needs and mitigate debt risks. A resilient, diversified financial strategy will enable India to achieve its climate goals while sustaining economic growth. Through collective effort and strategic planning, India can lead the way to a sustainable future, addressing both immediate needs and long-term environmental commitments.

(Monika is an Indian Economic Service officer. She is currently Assistant Director, NITI Aayog.)

Dr Badri Narayanan Gopalakrishnan is Fellow, NITI Aayog. Views expressed are personal.