From UPI to crypto reserves: In a move reminiscent of Franklin D Roosevelt’s strategic gold accumulation during the Great Depression, US President Donald Trump’s proposal to create a Strategic Bitcoin Reserve has generated a flurry of anticipation within the global cryptocurrency market. Far from being a mere financial novelty, the initiative is being viewed as a calculated geopolitical and economic manoeuvre.

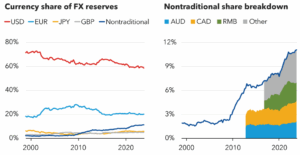

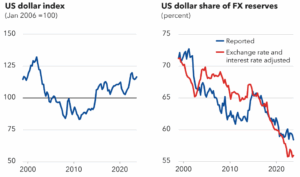

Strategic reserves—assets held by a nation’s central authority to manage financial stability, navigate economic uncertainty, and respond to geopolitical crises—have historically served as shock absorbers. Traditionally, these include gold, foreign currencies, special drawing rights, and petroleum reserves. Now, in an era defined by inflationary pressures and waning confidence in fiat currencies, Bitcoin and other digital assets are emerging as alternative instruments of financial resilience.

If adopted, Bitcoin would begin as a flexible but largely symbolic addition to the US reserves, with limited immediate impact on the dollar. However, its inclusion may catalyse longer-term global shifts—particularly around de-dollarisation. As Bitcoin operates independently of any single nation-state, its widespread adoption could weaken the influence of the dollar in global trade and sanctions enforcement.

READ I To fix the US trade deficit, fix the fundamentals

Crypto reserves vs gold reserves

Initially, Bitcoin could function alongside gold—a time-tested countercyclical asset—and diversify America’s balance sheet. But should digital assets become mainstream, they may begin to displace gold’s prominence. By incorporating Bitcoin early, the US could shape this transition and retain financial leverage in a decentralised future.

Importantly, the US is not the first mover. El Salvador formally adopted Bitcoin as a strategic reserve in 2021. Bhutan has gone a step further, launching state-owned Bitcoin mining operations and retaining the mined cryptocurrency in its reserves.

The advantages of such diversification are significant. Bitcoin’s blockchain architecture provides transparency and immutability, enabling real-time audits and eliminating concerns over the opacity of fiat reserves. Its global accessibility and liquidity ease cross-border transactions, reducing the logistical complexity associated with gold or foreign currency reserves. Moreover, Bitcoin’s decentralised and censorship-resistant nature offers a layer of protection from external economic interference—enhancing national financial sovereignty.

Nonetheless, serious challenges remain. Regulatory ambiguity persists across jurisdictions, with governments struggling to formalise rules for cryptocurrency legitimacy. While proponents argue that Bitcoin’s volatility evens out when viewed through a long-term macroeconomic lens, conservative central banks remain sceptical. Security, too, is a pressing concern. Without robust digital custody solutions, national holdings remain vulnerable to cyberattacks. Furthermore, Bitcoin’s decentralised ethos poses an existential challenge to traditional banking systems, prompting caution from regulators and monetary authorities alike.

The emerging global financial order

The global financial order is shifting rapidly. The relevant question is no longer if digital assets will reshape the future—but how nations will position themselves to benefit. For India, this presents both a challenge and an opportunity.

India has already demonstrated remarkable agility in adapting to technological and financial innovation. The rapid deployment and global recognition of the Unified Payments Interface (UPI) exemplify this capability. Riding this momentum, India could take the next logical step by developing a national strategy for crypto reserves. Doing so would improve economic autonomy, reduce reliance on foreign-dominated financial systems, and insulate the country from external geopolitical shocks.

A phased approach to crypto reserves

A prudent and phased approach is key. India need not make a dramatic shift overnight. Even allocating a small portion of its reserves to digital assets would mark a bold, data-driven beginning—allowing room for real-time performance assessment and course correction. By observing early adopters such as the US, El Salvador, and Bhutan, India can craft a measured strategy tailored to its economic context.

Moreover, domestic financial institutions can be encouraged to pilot crypto-backed instruments under strict regulatory oversight. Simultaneously, India’s tech talent and blockchain expertise—already sought after globally—can be harnessed to build domestic capability in crypto asset management, digital security, and financial infrastructure. Establishing a policy framework for national cryptocurrency reserves could foster a new industry, spurring research hubs and a high-skilled workforce.

Countries such as Japan and Singapore have already achieved a balanced governance model for digital assets, blending innovation with regulatory rigor. India, with its digital track record and institutional competence, is well-positioned to replicate and improve upon these models.

The time to act is now. Digital asset adoption is accelerating—among both individuals and sovereign entities. To remain a leader in the global digital economy, India must proactively shape its role in the crypto-financial future. A crypto reserves strategy would not only enhance India’s financial resilience but also dovetail with the broader goals of the Digital India initiative.

Having already redefined digital payments, public service delivery, and identity verification infrastructure, India has the credibility, capability, and urgency to take the next decisive step—ushering in a new era of digital financial leadership.

Radha Kaushik is a research scholar at the Indian Institute of Foreign Trade, New Delhi.