The Narendra Modi government has just 12 months left in its second term, and the government’s economic reforms programme is stalled once again. Looking at two measures—the frequency of revisions of foreign direct investment (FDI) limits through the issuance of Press Notes, and our own India Reforms Scorecard — the government’s reform agenda has demonstrably stalled, and the government will fall well short of the pace of reforms from its first term in office. These are not the expected results from a government that won a new term with an enhanced mandate while facing an economic slowdown.

Nine years ago, we created a new tool, the India Reforms Scorecard, to track the pace of key job-creating economic reforms over time. The scorecard looks at 30 significant reforms the Indian government should consider and updates progress on a monthly basis. This list is created through a multi-step process that involves reviewing the “wish lists” of industry bodies and economists, a survey of top economic leaders, and multiple in-person sessions to debate the merits of each reform that is considered for the list.

READ I Census 2021: Absence of population data may hinder decision making

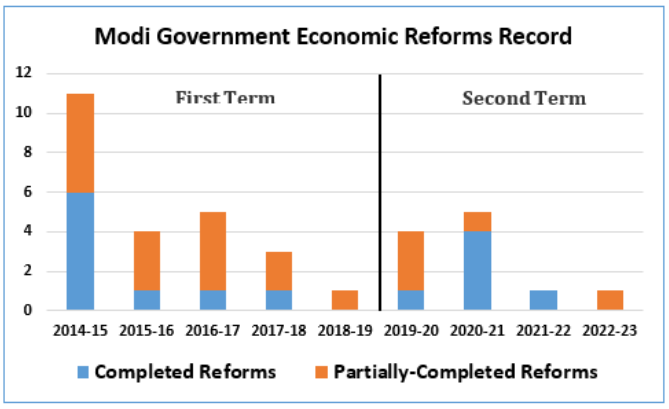

During its first term, the Modi government completed 9 of the 30 reforms we track and partially-completed another 15 reforms. The pace was a quite uneven— 6 of the 9 “completed” reforms happened in the government’s first 12 months. But the total number of reforms was impressive, ranging from well-known reforms like the Goods and Services Tax (GST) and the Insolvency and Bankruptcy Code (IBC) to lesser-known reforms like abolishing the “small scale reservations list” for manufacturing.

The slower pace of reforms at the end of the first term carried over into the second term. Our team pulled together a new list of 30 high-impact reforms to refresh our Scorecard. With a larger mandate following the spring 2019 election, the Modi government only moved on a single reform from our revised “Scorecard” in its first year in office, decreasing the corporate tax rate to be more aligned with competing markets.

However, fears of a Covid-triggered economic calamity stirred the government’s reform instincts, with four reforms completed in 2020-21 and another key reform the following year. However, the government has not completed any other significant reform in over a year. While the “pre-election pause” on big moves is often over-stated, the timeline for action is decreasing.

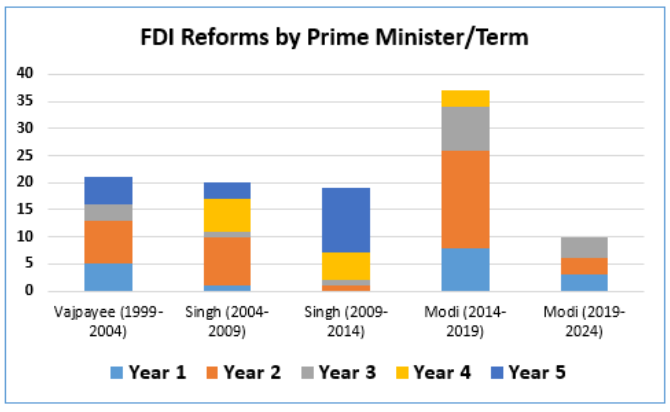

Similarly, the Modi government’s moves on liberalizing foreign investment regulations have been erratic. During his first term, the government made nearly 40 positive changes to the nation’s FDI regulations— nearly double the pace of either the Vajpayee or Singh governments. But almost all these changes came in the government’s first three years of its first term.

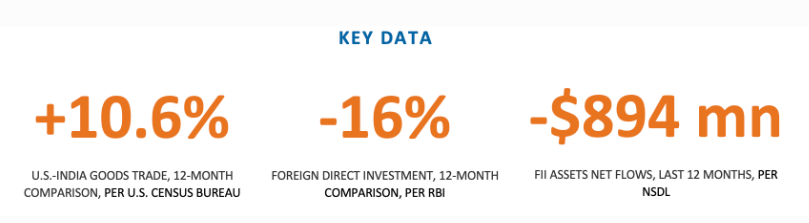

And during its second term, the Modi government showed courage in liberalizing politically difficult sectors like defence, telecommunications, and insurance. Yet few other sectors have seen any action. This second term is headed to become the worst-performing period for FDI reforms since the mid-1990’s. And it is not for lack of potential targets. Despite multiple decades of reforms, dozens of sectors still have FDI bans, FDI limits, or other regulations that worsen the playing field for foreign investors.

India’s economic growth is predicted to be well above global averages for large nations at around 6.5% this year and next, according to the Asian Development Bank (ADB). This is good, but well below India’s peak years in recent decades. According to India’s own foreign direct investment numbers, there is little evidence that India has become the new global destination-of-choice. In fact, FDI totals decreased by 15 percent between the first three quarters of fiscal year 2021 to 2022. At its current rate, India’s FDI total this year will be around $50b, which is around its 10-year historical average.

There is still time for another push towards reforms. The government has three more sessions of Parliament before the national election, and many reforms do not require legislative change. If the government is confident that it will return to office next year, steps must be taken today to ensure continued economic vibrancy during the next term. And, of course, the “shifting global supply chains” conversation continues to intensify. India has a unique chance to win high levels of new investments.

Richard Rossow is a leading expert in US-India commercial ties. He leads the India program at the Center for Strategic & International Studies, and the India advisory team at McLarty Associates.