Towards a fair carbon tax mechanism: Launched in 2021, the Carbon Border Adjustment Mechanism is a critical component of the EU’s Fit for 55 package, which seeks to cut greenhouse gas emissions by 55% below 1990 levels by 2030 and achieve carbon neutrality by 2050. CBAM looks to prevent carbon leakage by imposing a carbon price on imported products (cement, iron and steel, aluminium, fertilisers, electricity, and hydrogen) entering EU markets based on their embedded carbon emissions. These six sectors together account for almost 45% of the carbon emissions under the EU Emissions Trading System.

CBAM requires both developing and developed countries to pay the same carbon price for imported goods, which conflicts with the principle of Common But Differentiated Responsibility (CBDR) contained in the UNFCCC. The developed world has historically exploited the environment to a greater extent and for a longer period, leading to a widespread belief that the EU must address the climate justice-related aspects of carbon pricing and taxation. However, there is limited literature on what the EU should do to address these issues.

READ I India must break the grip of Big Tech on digital news

To draw an analogy, let us view carbon emissions as vehicles that countries seek to park in a full or almost full parking lot. The situation has become complicated over the years because those who have already parked their vehicles (developed countries’ historical emissions) refuse to vacate the parking lot (due to lack of technology or unwillingness to fund such an initiative) and refuse to return to the lifestyle of the pre-industrialisation age by giving up modern comforts. Due to this limited parking space, the Global North has become the self-appointed custodian of the parking lot, imposing a very high parking fee (with measures such as CBAM) on the rest of the world, especially developing countries.

The relevant question we should address is who should pay the parking fee and in what proportion. One way to address this disparity is to tax the polluter based on historical carbon emissions rather than the current level of emissions.

A fair carbon tax

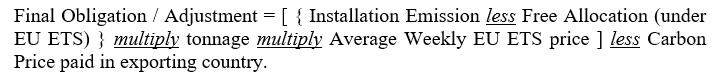

There is a need to calibrate the cross-border carbon levies or taxation according to the polluter pays principle and factoring in the CBDR. Let us examine the proposed method for calculating the tax under CBAM. The current equation is as follows:

The equation essentially seeks to take advantage of the arbitrage between the EU ETS price and the carbon price in the exporting country. In other words, even if the exporting country taxes the entire emission, albeit at a lower market-determined price (due to the difference in the nationally determined contributions (NDCs) trajectory), the Final Obligation / Adjustment would always be positive.

We propose that for a fair tax incidence, the Final Obligation / Adjustment be multiplied by a factor that accounts for cumulative historical emissions over at least the past 120 years. We chose 120 years because emissions are calculated in either CO2 or CO2e terms, and the half-life of CO2 is 120 years. There are two ways to arrive at the multiplication factor.

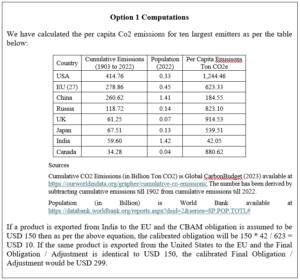

Option 1: Per capita emissions as an adjustment factor

We propose that per capita emissions be adopted as the adjustment factor to calibrate the Final Obligation / Adjustment. The equation could be as follows:

Calibrated Obligation = EU CBAM obligation × (India’s per capita CO2 emission in tons divided by EU’s per capita CO2 emission in tons)

Although carbon leakage will continue in the short to medium term, the advantage of this equation is its dynamic nature. For 2025, emissions for year 0 (1903) would be subtracted, and emissions for year 121 (2023) would be added. Therefore, the calibration factor would continue to increase for countries that continue to develop and emit more.

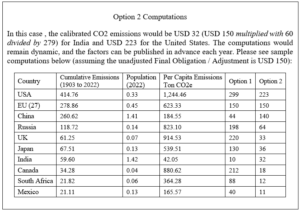

Option 2: Cumulative emissions as an adjustment factor

We understand that attributing cumulative emissions for the past 120 years to the population in year 120 may appear unfair to some. Therefore, one could theoretically calculate the weighted average per capita emissions for the past 120 years or adopt another simpler approach. Under the simpler approach, the cumulative emissions could be adopted as the adjustment factor, and the equation could be as follows:

Calibrated Obligation = EU CBAM obligation × (India’s cumulative CO2 emissions in tons divided by EU’s cumulative CO2 emissions in tons)

This approach fixes the liability according to the total number of vehicles parked in the parking lot instead of the number of new vehicles trying to enter.

We are mindful of the realities of international relations. The Global North would oppose this proposal to the fullest extent, and it might not see the light of day. In such a scenario, the domestic carbon prices, energy taxes, and environmental taxes of the Global South could be applied to imported goods based on reverse calibration. The legal standards that the EU hopes to apply to justify CBAM would be equally applicable to such reverse-calibrated levies from the Global South. The selection of commodities on which the Global South could retaliate is the subject of another paper.