By Parthajit Kayal

Financial econometrics is one of the most sought-after subjects in quantitative finance and empirical finance. It supplements the necessary knowledge required to master many of the data science and machine learning concepts. Obviously, there is quite an interest among the students to learn this subject but many fear the complexity of mathematical derivations. Therefore, the main challenge for an instructor or an author is to express the complex topics in a very simple way, but still provide the necessary intuitive grasp on the underlying concepts for the readers.

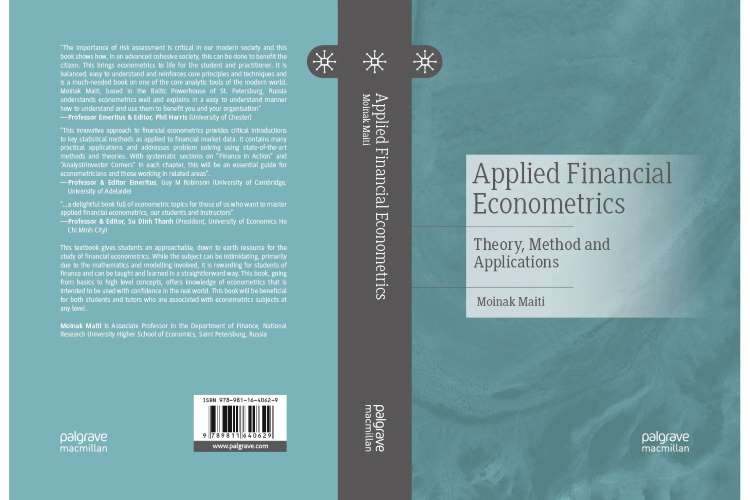

This book, Applied Financial Econometrics: Theory, Methods and Application by Moinak Maiti, is a great attempt towards the goal. Unlike many other financial econometrics books, this one emphasises on the practical use as opposed to just theoretical discussion. It covers many highly relevant empirical finance topics (basic to advanced spectrums) with practical examples. Further, it also guides students with a detailed hands-on approach through EViews and R programming.

READ I TechFins: Why India must stop their unregulated, untaxed run

Conceptual framework

Major broad themes covered in this book are Random Walk Hypothesis, Geometric Brownian Motion, Efficient Frontier, Portfolio Optimization, Asset Pricing Factor Models, Risk Analysis, Fat Tail Distribution, Threshold Autoregression, and Wavelets. Authors have provided a detailed background of each topic in separate chapters and with stepwise software implementation of the real-world problems with corresponding comprehensive interpretations, case studies, and practice exercises.

It provides a solid bridge between theoretical econometrics and applied financial econometrics. The topics discussed in this book can be useful for undergraduate and postgraduate economics, finance, and management students who are studying courses such as asset pricing, theory of finance, corporate finance, risk management, etc. In addition, the hands-on methods used in this book can help instructors and young researchers focusing on practical problem-solving in finance.

This book starts with a discussion on the evolution of econometrics, software packages and their applications in financial markets. Keeping in mind that many readers may not have necessary statistical, econometrics, and statistical software exposure, this book discusses all the essential concepts in a very lucid manner to provide a basic understanding for the readers. This makes the book demand very little need for any prerequisites and anybody interested in financial analytics in general, could benefit from it.

The author describes the difficult concepts like Random Walk, Martingales, Brownian Motion, Wiener Process, Option Valuations, Monte Carlo Simulation in a most simplistic manner with hands-on applications for practice and exercise. Those interested in learning more about risk-returns estimation and portfolio optimization techniques can refer to this book as the author discusses different types of risk measures with their estimation process and practical applications.

READ I Labour reforms: How labour codes gave social dialogue, consultations a miss

Applications of financial econometrics

The portfolio optimization technique can be very handy for those who are looking for financial investment-related applications. Moreover, the chapter on Asset Pricing factor models teaches different techniques for pricing financial assets like debts, equity, bonds, derivatives, etc. through simplified discussion on different versions of Capital Asset Pricing Models, Fama-French Factor Models, and Arbitrage Pricing Theory. The author also illustrates different statistical tests, econometrics tools, estimation processes that are most relevant in this context.

Finance theories and their applications have become very important aspects for many academicians and practitioners. With the availability of time series data, volatility modelling is one such important area that has drawn significant interest among many in the last few decades. This book discusses many advanced methods and tools that are commonly used for volatility modelling through sophisticated and beautiful integration of Econometrics and real-world use of it.

A separate chapter with the detailed deliberation on Fat-tailed distribution immensely helps and guide investors form different financial markets. Inclusion of thorough discussions on Threshold Autoregression and Wavelets techniques teach the reader how to deal with non-linearity, structural breaks, heterogeneity, regime-switching, etc. in time series data.

Overall, this book represents a novel and refreshing treatment of financial econometrics written in plain English, based on simplified notation and case studies. It provides a complete balance between theory and practice, with numerous reader-friendly illustrations of real-world applications.

Certainly, this book will help and inspire many students not only to enhance their technical knowledge of the financial market, but also to foster a desire to pursue a career in the finance industry. I would recommend this book to theorists, practitioners, as well as for advanced students of econometrics, financial markets and management.

(Parthajit Kayal is Assistant Professor in Finance at Madras School of Economics)