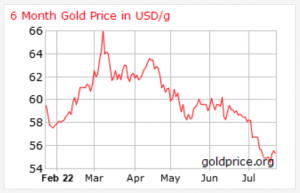

Gold demand in India: Throughout history, gold has been seen as a hedge against inflation and a safe haven during economic uncertainties. The world economy is passing through a turbulent period amid runaway inflation and recession fears, but gold prices have fallen 15% since March. During this period, the US dollar index has risen 9%.

The government had raised the import duty on gold to 12.5% from 7.5% on July 1, leading to a sharp rise in domestic gold prices. This was done to check depreciation of the rupee against the dollar and to reduce the soaring current account deficit. Including the cess and surcharges, the charges on gold imports have risen to 16.25%, from 10.75%. Sale of gold in India also attracts a 3% GST.

Gold has significant importance in Indian history and culture. In Indian families, gold jewellery and ornaments are passed on from generation to generation to keep the family legacy alive. Gold is a symbol of wealth and status. So, it is more than just an investment for Indians. India is the second largest consumer of gold after China, but per capita consumption is still low in the country. According to the World Gold Council, households are saving proportionately less than they used to, and this may reduce the amount they allocate to gold.

READ I Fed effects another massive interest rate hike

Gold demand and prices in 2022

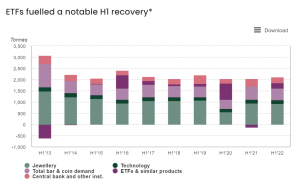

The gold demand rose 43% in the April-June quarter, to 170.7 tonnes from the same period last year due to higher purchases on account of the wedding season and the festival of Akshaya Tritiya. The consumption in the first six months of 2022 rose 43% to 306.2 tonnes despite a 5% hike in import duty on the yellow metal. According to the World Gold Council estimates, the domestic consumption of gold in 2022 would be 800-850 tonnes, but the actual purchases could be lower because of the likely slump in the second half.

Inflation measured by the consumer price index stayed above 7% for the sixth consecutive month in June. The RBI is on a rate hiking spree and is expected to increase policy rates by 50 basis points this month to keep up with the policy action in the United States and other developed economies. When inflation rises, the value of currency decreases. In this type of economic situation, most of the asset classes fail to deliver returns that can beat inflation.

People start investing more in gold during inflationary periods to preserve the value of their assets and investments, resulting in spikes in demand and price. Another major factor that affects the demand is import duty. Since the domestic production of gold is negligible, India imports huge amounts of gold. This often results in ballooning of trade deficit and problems with current account.

The government uses import tariff as a tool to control the quantity of imports as well as domestic prices. High prices affect domestic demand. Interest rates also have an impact on gold demand. When interest rates are significantly low, people start investing in gold to get desirable returns, and the demand for gold increases in such situations.

READ I Indian economy: IMF and other forecasters miss domestic, global pain points

Monsoon rains and gold demand

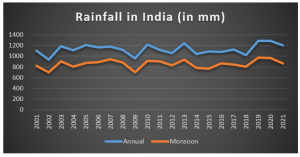

Monsoon is one of the major factors that affect the demand for gold in India, an agricultural economy where more than 60% of the population depend on farming for livelihood. Monsoon is the most important season for the Indian economy. Crops such as wheat, rice, and pulses require good rainfall to grow. India gets 60–70% of its annual rainfall during the monsoon season.

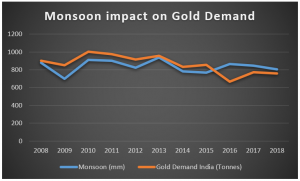

A delayed or weak monsoon can create supply issues and may affect the economy. Gold is an important part of our rural economy and around 60-65% of gold demand comes from rural India. The penetration of gold is much greater than that of the banking system in the rural parts of India. In rural India, many households don’t have any access to the formal banking system, so jewellery is a store of wealth for these people. Indian farmers spend a significant part of their surplus income on gold. When it comes to weddings in rural areas, gold is a large part of the total expense, while in urban areas people spend on other elements of weddings. So, rural economy significantly drives the demand for gold.

A bad monsoon may lead farmers to buy less gold or even sell gold at critical times. When the monsoon is good, the overall farm output goes up, which boosts the income of rural people. A good monsoon can significantly increase the surplus income in rural areas, which in turn may increase the overall demand for gold. So, monsoon plays very crucial role in the gold demand.

The above graph shows that the demand for gold in India moves with the monsoon. Only 2016 was an exception to this trend, mainly because of demonetisation. Overall, we can see that there is a high correlation between the monsoon and demand for gold in India.

Recently, The India Meteorological Department (IMD) updated its forecast for 2022 monsoon to 103% of its long-term average from the earlier prediction of 99%. If this comes true, then it will be the 4th straight year with normal or above normal monsoon. A favourable monsoon season may increase the total demand for gold in India and this may also help bring down the inflationary pressure in the economy.

(Rohit Modar is a student at the National Institute of Securities Markets, Mohopada.)