The Indian economy is reeling under the impact of the Russia-Ukraine war that has affected its fragile recovery from the pandemic crisis, and the biggest challenge is boosting private investments, said the Reserve Bank of India in the April edition of its monthly bulletin. The revival in economic activity faces risk from spillovers of the geopolitical crisis, it said.

The Russia-Ukraine conflict saw crude oil prices shooting through the roof, touching $140 per barrel. The Indian economy is vulnerable to spikes in oil prices as the country depends on imports to meet 80% of its energy needs, said the bulletin written by a group of twenty RBI employees. The RBI was quick to acknowledge the negative impact of oil prices on economic growth. At its April meeting, the monetary policy committee cut its GDP growth projection for 2022-23 to 7.2% from 7.8%.

READ I WPI inflation soars to record 14.55% in March

Indian economy and RBI policy

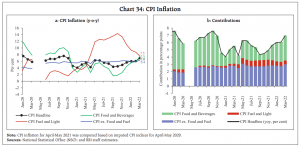

The monetary policy committee also revised its inflation forecast for 2022-23 to 5.7% from 4.5%. It assumes a normal monsoon this year and expects the crude oil prices to hover around $100 per barrel. The Indian economy is facing price pressures with retail inflation (CPI) rising to 6.95% in March compared with 6.07% in February and 6.01% in January, above the RBI’s comfort range.

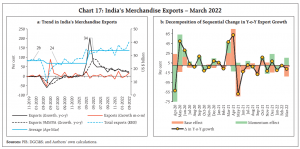

India’s merchandise exports performed well to achieve the target of $400 billion despite global disruptions. Services exports also soared and robust remittances inflow ensured an account surplus that cut the deficit from merchandise trade. The external sector remained robust with huge forex reserves.

READ I India-UK FTA: Unleashing the bilateral trade potential

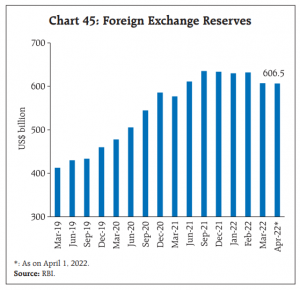

The RBI is sitting pretty on foreign exchange reserves of $604 billion. This means that it can sell the dollar from its reserves to protect the rupee from wild fluctuations. Still, widening trade and current account deficits along with portfolio investment outflows could put pressure on the external economy. The bulletin says India is facing these challenges with strong fundamentals and buffers.

“Most sectors of the economy are reaching or have exceeded pre-pandemic levels. Notably, bank credit has gathered pace and the job market is gathering steam. There is an acceleration in the travel and hospitality sectors. The construction and real estate sector have also registered a pick-up,” said the bulletin.

The RBI’s efforts to improve the transmission of policy rates to commercial banks’ interest rates will strengthen with the introduction of the EBLR regime, the bulletin said. “The earlier internal benchmark-based lending rate regimes suffered from a multitude of issues such as arbitrariness in calculation of the base rate/MCLR and spreads; long reset clauses which inhibited efficient monetary transmission,” it said.

An increase in capacity utilisation by the manufacturing industries sector was witnessed in the Oct-Dec quarter of 2021-22. A robust Rabi output is expected to boost rural demand and revival of contact-intensive services may help boost urban demand. The RBI sees investment activity picking up with improvements in business confidence and bank credit pickup.