India’s climate strategy: The global regulatory scenario on climate change and green transition is evolving rapidly. The European Union has positioned itself as a self-appointed custodian of driving the global green transition — on its own terms. Over the past few years, the EU has introduced a plethora of regulations, including the carbon border adjustment mechanism, EU deforestation regulation, corporate sustainability due diligence directive, forced labour regulation, and foreign subsidies regulation.

While these measures are framed as efforts to ensure a level playing field and promote green transition, they often reflect protectionist tendencies. By leveraging its strong linkages to global value chains and its high import appetite, the EU is accused of using these regulations to consolidate its economic position. In contrast, the United States under a Trump administration is expected to weaken domestic environmental regulations, scale back climate financing, and retreat from global commitments on climate action.

READ I Only innovation can revive SLB market

COP29 and the global climate finance divide

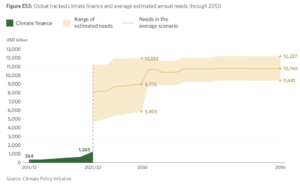

The COP29 summit in Azerbaijan highlighted the growing divide between developed and developing nations on climate finance. The developed nations’ last-minute commitment to provide $300 billion annually from 2035 drew sharp criticism from the Global South. This pledge was seen as a disregard for the United Nations Framework Convention on Climate Change’s (UNFCCC) principle of “common but differentiated responsibilities and respective capabilities,” which calls for differentiated climate obligations based on national circumstances.

The US and EU, responsible for nearly 50% of historical emissions (compared with India’s 3% and even lower contributions from other developing nations), were criticised for their inadequate commitment to climate finance. The Global South fears that Trump’s trade protectionist policies and the EU’s “green protectionism” could disrupt trade flows and economic linkages, compounding the challenges for countries like India.

India’s climate strategy

India’s climate strategy must be tailored to its unique economic and developmental context while remaining cognizant of evolving global regulations. The Government of India has already undertaken significant reforms to achieve sustainability targets. Recent initiatives include:

Carbon credit trading scheme (CCTS): An explicit carbon tax requiring industries to pay for emissions exceeding set targets.

Renewable purchase obligations (RPO): Stricter compliance trajectories for renewable energy procurement.

Extended producer responsibility (EPR): Targets promoting recycling.

Green credits programme: Incentivising positive environmental actions by individuals and entities.

While these measures are promising, India must address systemic challenges to ensure that its Net Zero commitments align with economic growth and global regulatory expectations.

Strengthening domestic climate policies

India must adopt a more holistic, centrally coordinated approach to climate change policy. Efforts across various ministries and state governments need better alignment. To this end, establishing a central administrative body to monitor green transition regulations, assess their impacts, and review progress towards India’s Nationally Determined Contributions (NDCs) is imperative.

India’s regulatory framework must avoid overlapping taxes that burden industries with complex compliance. For instance, both the Renewable Purchase Obligations (implicit carbon tax) and Carbon Credit Trading Scheme (explicit carbon tax) impose dual penalties on non-compliant units. Introducing a unified explicit carbon tax could simplify compliance, improve monitoring, and align with global carbon border tax mechanisms.

While renewable energy (RE) generation costs have declined, additional interstate levies and charges nearly double the landed cost of RE power. This discourages industries from adopting RE, particularly when interstate transmission is required. Reducing these levies could make RE more competitive with thermal power and encourage industrial adoption.

India’s climate finance framework requires urgent restructuring and centralisation. Instances of unutilised or diverted funds—such as the Environment Compensation Charge (ECC), Coal Cess, and Compensatory Afforestation Fund Management and Planning Authority (CAMPA)—highlight inefficiencies. All carbon tax collections must be transparently deployed for climate action. If necessary, existing tax structures should be overhauled to ensure funds serve their intended purpose.

Mobilising innovative climate finance

Policymakers should develop a comprehensive climate finance strategy to mobilise resources through innovative instruments and public-private partnerships. Options include:

Conditional green loans: Central government loans to states tied to green project execution.

Climate tech ecosystem: Leveraging India’s burgeoning climate tech startups to attract venture capital (currently estimated at only $1–1.5 billion annually).

Corporate involvement: Encouraging large corporations to invest in green initiatives.

India must act swiftly to align its industrial policies with climate regulations. A comprehensive climate finance strategy, streamlined regulations, effective monitoring mechanisms, and incentives for green investments are crucial. With limited time to adapt, India must balance its developmental aspirations with its Net Zero commitments while navigating the evolving global regulatory landscape.

By taking these steps, India can emerge as a leader in sustainable growth while ensuring that its industries remain competitive in the face of global challenges.

The author is a Mumbai-based corporate economist.