Shadow banks operate as complementary counterparts to traditional commercial banks, specialising in facilitating low-ticket-size loan arrangements, sourcing funds, and pioneering the adoption and testing of cutting-edge technologies ahead of the conventional banking system. To foster transparency between these entities and established banks, regulatory measures have been introduced by the RBI.

The inherent advantage of cost-effective operations enjoyed by shadow banks complements the low cost of funds associated with commercial banks. This dynamic collaboration enables shadow banks to work in tandem with their commercial counterparts, extending affordable loan options to underserved segments of the population.

In a country boasting a population of 1.4 billion individuals, a mere 65 million file income tax returns. The financial landscape, encompassing both conventional banks and shadow banking entities, bases loan eligibility criteria primarily on income tax submissions. However, the coverage of credit data by the four primary credit bureaus is limited, covering only around 150-160 million people. Consequently, a mere 10-12% of the nation’s populace has access to loans through regulated entities. This gaping disparity underscores the exclusion of a vast majority from the formal financial framework.

READ I Forest Bill 2023: Diluting conservation or promoting development

Shadow banks boost financial inclusion

While the regulatory responsibility for overseeing banks rests with the RBI, the nation’s banking sector is more expansive than commonly perceived, incorporating cooperative banks and shadow banking entities. The escalating trajectory of India’s GDP, breaching the $3 trillion mark and projected to surge to $48 trillion by 2047, casts the spotlight on the adaptability of existing regulatory paradigms.

The ever-evolving and expanding banking landscape necessitates a pliable regulatory approach to accommodate unforeseen transformations. In this light, the formulation of a comprehensive 25-year strategy emerges as a pivotal requirement, steering clear of overregulation that could impede the sector’s growth. This, in turn, demands the establishment of a specialised framework equipped to navigate the evolving terrain of financial services.

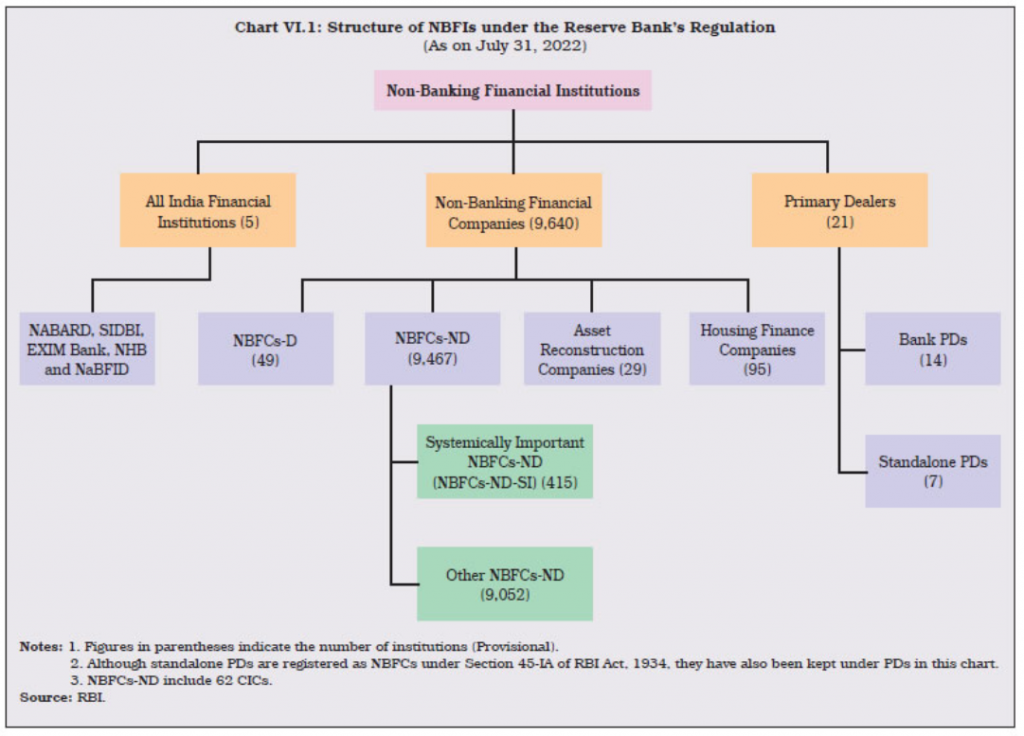

Central to the discourse is an incisive examination of the practice whereby banks delve into insurance activities, accompanied by a perplexing insistence on selling insurance products in conjunction with loan offerings. Advocating for a more specialised approach, akin to consulting a specialist for a particular medical condition, is at the heart of the argument. Consequently, it is recommended that banks be restricted from venturing into the non-banking financial company (NBFC) sphere or establishing non-deposit taking financial companies (NDFCs).

The observed trend of banks acquiring stakes in NBFCs, thereby endeavouring to simultaneously operate in both domains, runs counter to the broader banking licences granted. A parallel narrative emerges from the fintech sector, where lending assumes a pivotal role in the financial success of startups. This reinforces the call for robust regulations in the fintech realm, ensuring equitable and responsible lending practices. Heightened concerns about potential data mismanagement and misuse by fintech entities further underscore the urgency for a robust system that bolsters data security, safeguards privacy, and counteracts cyber threats that could compromise sensitive financial information.

Within this context, an array of facets beckons for comprehensive exploration, encompassing data access, external ratings for bank borrowings, and the imperative for effective regulations. The escalating complexity engendered by overlapping data across various identification platforms and databases is a pertinent concern. The mandatory requirement for external ratings when seeking borrowings, despite banks possessing an extensive corpus of data concerning borrowers and corporate entities, raises valid questions about equity.

A persuasive argument is posited in favour of banks’ internally developed rating protocols, potentially superseding the reliability of external rating agencies. In this vein, a meticulous review of the criteria governing external ratings for bank evaluations, aligning them with the current capabilities of banks, becomes imperative. Furthermore, the labyrinthine challenges faced by the RBI in regulating cooperative banks and the latent merits of facilitating mergers between cooperative banks and small finance banks necessitate comprehensive examination. Guiding the trajectory forward is the indispensable need for a well-defined long-term roadmap, buttressed by effective regulations that nurture the sustained growth and stability of the financial ecosystem.

Another reason why shadow banks are important is the growth of India’s agricultural economy which is growing at a fast rate. Shadow banks are key to channelising the increased income for farmers and formalizing a thriving rural economy that generates palpable demand. Acknowledgment is extended to the transformative shifts witnessed within the financial landscape, exemplified by initiatives like GST, with a resounding anticipation of the sweeping changes poised to unfold in the near and distant future.

(Sunil Agarwal is managing director, Paisalo Digital Ltd. This article is the edited excerpt of Mr Agarwal’s presentation at an event organised by EGROW Foundation.)