A social security agreement with the US: While India’s strategic relationship with the United States has deepened significantly during the Biden administration, the re-election of Donald Trump as President of the United States brings renewed focus on unresolved trade and tariff issues. These longstanding challenges demand urgent attention if the two nations wish to sustain and strengthen their economic ties.

During his earlier tenure, President Trump labelled India a ‘tariff king,’ citing its high tariffs on American goods. He also terminated India’s preferential market access under the Generalised System of Preferences (GSP), prompting India to impose retaliatory tariffs on certain US products. Despite these disputes, bilateral trade has grown steadily, from $88 billion in 2019 to $119 billion in 2023.

Foreign direct investment (FDI) flows, however, paint a different picture. Annual FDI inflows from the US to India have remained stagnant at $4-5 billion, partly because many American companies prefer routing investments through third-party jurisdictions like Mauritius and Singapore. Addressing these investment barriers and diversifying trade partnerships will be crucial for advancing bilateral economic relations.

READ I Sustainability linked bonds: Only innovation can revive SLB market

Immigration policies and H-1B visas

One major concern for India is Trump’s stance on immigration, particularly for skilled professionals holding H-1B visas. During his first term, he raised the minimum wage for H-1B holders, making it harder for Indian IT professionals to obtain these visas. Despite these hurdles, Indian nationals still received 72.3% of all H-1B visas issued in fiscal year 2023, according to US Citizenship and Immigration Services (USCIS). This highlights the critical role Indian professionals play in fulfilling the demand for STEM-related jobs in the US labour market. Their contributions complement American workers, filling gaps in science, technology, engineering, and mathematics roles, and supporting economic growth.

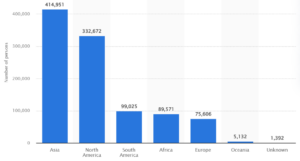

Number of green cards in 2022 by region of birth

A related issue is the absence of a totalisation or social security agreement (SSA) between the two countries, which disproportionately affects Indian professionals working temporarily in the US. Indian officials, including the commerce and industry minister, have consistently advocated for such an agreement to address this inequity.

Totalisation or social security agreement

A totalisation or social security agreement establishes a legal framework to coordinate social security systems between two countries, eliminating dual contributions, ensuring portability of benefits, and enabling totalisation of benefits for workers. First, it helps workers avoid contributing to the social security systems of both their home and host countries simultaneously. Second, it ensures that social security benefits, such as old-age pensions or disability payments, are accessible in either of the two countries, even if the worker relocates. Lastly, the totalisation clause allows work periods in both countries to count toward eligibility for social security benefits in either nation.

For instance, an Indian professional working in the US for a short duration often cannot meet the minimum requirement of 10 years to qualify for US Social Security benefits. At the same time, they continue contributing to India’s social security system. Without an SSA, these contributions in the US are effectively lost, resulting in dual taxation and financial hardship. Similarly, American professionals in India face a 12% contribution to the Indian Employees’ Provident Fund without the ability to repatriate these funds.

These agreements benefit not only workers but also retirees and employers by reducing costs and ensuring portability of benefits. While India has signed SSAs with 20 countries, including Belgium, Germany, and Japan, the absence of such an agreement with the US remains a significant gap.

Economic burden of dual contributions

Indian IT professionals on H-1B visas are required to pay US social security taxes, but many do not qualify for benefits due to the 10-year eligibility rule. According to estimates, these contributions amount to $3 billion annually, excluding additional contributions made by spouses on dependent visas such as L-2. These substantial amounts underscore the urgency of addressing this issue.

The burden extends to US professionals working in India as well. Although the number of Americans employed in India is significantly smaller, they face similar challenges. Their mandatory contributions to India’s social security system amount to a notable portion of their annual income, creating barriers for companies looking to expand operations in India. Resolving these issues through an SSA would benefit not only individual workers but also enhance the profitability and competitiveness of businesses on both sides.

US resistance and Indian advocacy

The US has resisted signing an SSA with India, citing incompatibilities between the two nations’ social security systems. For example, India’s Employees’ Provident Fund Organisation (EPFO) primarily covers formal sector workers, excluding a significant portion of the workforce employed informally. However, this objection is not insurmountable, as several European nations with similar disparities have signed SSAs with both India and the US.

India has raised the issue repeatedly in various forums, including the India-US Trade Policy Forum (TPF) since 2011. During the October 2024 TPF meeting, India presented comprehensive data on its social security programs to counter US concerns. Despite some progress, negotiations have not yet begun in earnest. American policies requiring 10 years of legal residency for repatriation of benefits remain a significant barrier, adversely affecting Indian workers on visas lasting only five to seven years.

A case for an India-US SSA

A bilateral SSA would eliminate dual taxation, allowing workers to avoid contributing to both systems simultaneously. It would also ensure that individuals dividing their careers between the two countries can access retirement and disability benefits. For businesses, reduced social security costs would improve profitability and enhance competitiveness.

Currently, the absence of an SSA imposes significant financial burdens on Indian professionals and hampers deeper economic engagement. Indian IT firms, which contribute billions to the US economy annually, face inequitable treatment under the current system. By contrast, American workers in India would similarly benefit from reduced contributions and greater portability of benefits. The agreement thus has the potential to create a level playing field for businesses and professionals alike.

During the June 2023 meeting between Prime Minister Narendra Modi and President Biden, a joint statement acknowledged the importance of an SSA for protecting cross-border workers. However, substantive negotiations have yet to begin. India must leverage its growing economic and strategic importance to prioritise this issue with the new US administration.

Addressing the absence of a totalisation agreement is not just a matter of equity but a pragmatic step toward enhancing bilateral relations. By eliminating dual taxation and ensuring benefit portability, an SSA would set the stage for a more robust and mutually beneficial partnership between India and the United States.

Krishna Kumar Sinha is an industrial policy and FDI expert based in New Delhi. His last assignment was as an industrial adviser in the department of industrial policy and promotion, DIPP, currently known as DPIIT, under the ministry of commerce and industry of the government of India.