Case for a wealth tax in India: A paper by Nitin Kumar Bharti, Lucas Chancel, Thomas Piketty, and Anmol Somanchi has once again triggered a discussion on the income and wealth inequality in India. The paper, Towards Tax Justice and Wealth Redistribution in India: Proposals Based on Latest Inequality, discusses in detail, the alarming rise of economic disparities in India and suggests steps to address them.

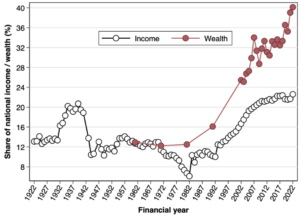

Economic disparities in India are at their historical peak, says the study, published in Economic and Political Weekly. By analysing data from income tax returns, national accounts, consumption, and wealth surveys, along with rich lists like Forbes, the authors provide a comprehensive picture of income and wealth distribution over a century. The paper is a follow-up note on an earlier study, Income and Wealth Inequality in India, 1922-2023: The Rise of the Billionaire Raj, by the authors. In this, they attempt to answer critics on the transparency of the data used for their study.

READ I India needs bold reforms to tackle inequality worse than colonial era

Income inequalities in India

Income refers to annual earnings from labour or capital (such as rent, dividends, interests, or retained earnings) before tax. To capture the income distribution, the study combines tax tabulations with consumption surveys from the National Sample Survey Office and the India Human Development Survey.

Rise of extreme inequality: Share of top 1%

Income surveys often underrepresent the wealthy, who are less likely to participate in these surveys. To address this, the authors used income tax tabulations from the Indian tax authorities, which offer a more accurate picture of the earnings at the top of the distribution. This data has been available since 1922, allowing a long-term view of income trends. If a wealthy individual earns substantial dividends from their investments, this income will be captured in tax records but might be missed in a general household survey. By combining these sources, the authors could map the distribution of income more accurately.

Case for a wealth tax

Wealth refers to the market value of assets owned by individuals, such as housing, equity, or businesses, minus any debt. The wealth data, starting from 1961, is supplemented by the Forbes billionaire list to account for the top end of the distribution. The findings are stark: the top 1% control over 40% of total wealth in India, up from 12.5% in 1980.

The All-India Debt and Investment Survey (AIDIS) provides detailed data on household assets and liabilities. However, similar to income surveys, AIDIS tends to miss the very wealthy. To correct this, the authors used the Forbes billionaire list, which tracks individuals with net wealth exceeding $1 billion. They fit a Pareto distribution to this list, estimating the wealth of the top 0.5% of the population. For example, if an industrialist owns several businesses and a vast real estate portfolio, their wealth is likely captured in the Forbes list but may be underrepresented in AIDIS. By integrating these sources, the authors could estimate wealth distribution more accurately.

The study faces criticism from some commentators who argue against the accuracy of the inequality estimates. However, the authors defend their methodology, emphasising the conservative nature of their estimates due to the unaccounted offshore wealth and the underrepresentation of the very wealthy in household surveys. For instance, it is estimated that over 1% of India’s GDP is parked as offshore assets by Indians in Dubai alone. This unaccounted wealth suggests that the true extent of inequality might be even higher than reported.

Wealth tax and inheritance tax

To address these growing inequalities, the authors propose a tax justice package consisting of an annual wealth tax and an inheritance tax, targeting only the ultra-wealthy. The proposed wealth tax would apply to individuals with net wealth exceeding ₹10 crore. Three variants of the tax package are suggested by the authors.

The baseline variant proposes a 2% annual tax on net wealth exceeding ₹10 crore and a 33% inheritance tax on estates exceeding ₹10 crore. This could generate 2.73% of GDP in revenues. For example, if an individual has assets worth ₹20 crore, they would pay ₹20 lakh annually as wealth tax.

The moderate variant introduces progressive rates, with a 2% tax on wealth between ₹10 crore and ₹100 crore and a 4% tax on wealth above ₹100 crore. The inheritance tax would be 33% on estates between ₹10 crore and ₹100 crore, and 45% above ₹100 crore. This could yield 4.6% of GDP in revenues. For instance, an estate worth ₹150 crore would face a 4% annual wealth tax on the excess over ₹100 crore and a higher inheritance tax rate.

The ambitious variant proposes even higher rates: 3% on wealth between ₹10 crore and ₹100 crore, and 5% above ₹100 crore. The inheritance tax would be 45% on estates between ₹10 crore and ₹100 crore, and 55% above ₹100 crore. This could generate 6.1% of GDP in revenues. For example, an estate worth ₹200 crore would face a 5% annual wealth tax on the excess over ₹100 crore and the highest inheritance tax rate on the estate value exceeding ₹100 crore.

The inheritance tax seeks to address unearned dynastic wealth, exacerbated by the caste system. The tax would apply to estates exceeding ₹10 crore, directly targeting the transfer of substantial wealth across generations. For instance, if a business magnate bequeaths an estate worth ₹50 crore to their heirs, the portion exceeding ₹10 crore would be subject to the inheritance tax.

Fiscal impact and social sector investments

The potential revenue from these taxes is enormous, despite affecting only 0.04% of the population. These revenues could significantly increase public investment in health, education, and other social sectors, which have been historically underfunded.

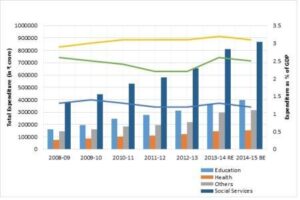

Currently, the government spending on health and education in India is below global standards. Public health expenditure has stagnated around 1.4% of GDP, while education spending has hovered around 2.9% of GDP. The proposed wealth taxes could dramatically increase these investments.

India: Public spending on health and education

If the baseline wealth tax variant were implemented, generating 2.73% of GDP in revenues, this could nearly double the current health budget. For instance, additional funding could improve healthcare infrastructure, expand access to medical services in rural areas, and enhance public health programs.

Similarly, the increased revenue could bolster the education sector, funding initiatives like school infrastructure improvements, teacher training programs, and scholarships for underprivileged students. For example, tripling the health expenditure alone could fund new hospitals, better equipment, and higher salaries for medical staff, directly improving the quality of healthcare available to the general population.

Inequality, caste, and redistribution

A unique aspect of economic inequality in India is its intersection with caste. The study reveals that nearly 90% of billionaire wealth is held by upper castes, with Scheduled Tribes (STs) and Other Backward Classes (OBCs) significantly underrepresented among the ultra-wealthy.

The authors coded the surnames in the Forbes billionaire rankings to categorise wealth by caste. They found that upper castes own a disproportionately large share of national wealth. This skewed distribution suggests that progressive tax measures would primarily benefit lower castes and middle classes, helping to address deep-seated social inequalities.

For instance, if the proposed wealth tax revenues were used to fund targeted social programmes, they could provide financial support and educational opportunities to historically marginalised communities. Scholarships for SC and ST students, job training programs for OBCs, and healthcare initiatives in underserved areas could significantly improve socio-economic mobility.

Broader democratic debate

The paper presents a compelling case for progressive wealth taxation and inheritance tax as means to combat extreme inequality in India. By targeting the top 0.04% of the population, these measures could generate substantial revenues for vital social investments, promoting a more equitable and prosperous society.

The authors emphasise that the specifics of the tax package should emerge from a broader democratic debate. The proposed thresholds, tax rates, and progressivity should be refined through public discourse and policy discussions.

From an ethical and moral standpoint, it is imperative to question whether it is just for a society to allow such extreme concentration of wealth while significant portions of the population struggle with basic needs. The proposed tax measures aim to create a fairer society by redistributing wealth and investing in public goods that benefit the majority.

As the 2024 Lok Sabha elections come to a close, the debate on wealth redistribution is expected to be reignited. It is crucial that this momentum translates into policy action, implementing progressive wealth taxation, effective redistribution, and broad-based social sector investments for an equitable and prosperous India. By addressing the stark economic disparities and promoting tax justice, India can pave the way for a more inclusive and just society, ensuring that the benefits of economic growth are shared more equitably among all its citizens.

Anil Nair is Founder and Editor, Policy Circle.