Export promotion schemes: India’s export sector is grappling with subdued global demand and ongoing trade disruptions. In this uncertain environment, the Union government is intensifying efforts to bolster the sector through export promotion schemes. With the Remission of Duties and Taxes on Exported Products (RODTEP) and Interest Equalisation Scheme (IES) nearing their expiry dates, policymakers are under pressure to extend these initiatives to safeguard the country’s export competitiveness.

The decisions that will emerge from discussions between the department of commerce and the ministry of finance in the coming weeks could have significant implications for exporters, particularly those in labour-intensive and MSME sectors. Moreover, the potential reallocation of unutilised funds from the Rebate of State and Central Levies and Taxes (ROSCTL) scheme highlights the government’s approach to managing budget constraints and supporting vital export activities.

READ I Online gaming: India needs clear norms, tax reforms

RODTEP and IES: Key export promotion schemes

The RODTEP scheme, introduced in 2021, is one of the most important initiatives for supporting exporters by refunding embedded, non-creditable central, state, and local levies paid on inputs. This scheme replaced the Merchandise Exports from India Scheme to comply with World Trade Organisation (WTO) norms. With an allocation of ₹16,575 crore for FY25 under the Union Budget, RODTEP is critical for exporters seeking greater market access.

However, given the current contraction in exports, there are concerns that the allocated budget for export promotion schemes may fall short if export activities pick up pace. In such a scenario, unutilised funds from the ROSCTL scheme, particularly in the textiles sector, may be redirected to support RODTEP. The government’s decision on additional funding will be crucial in ensuring the scheme’s continued effectiveness.

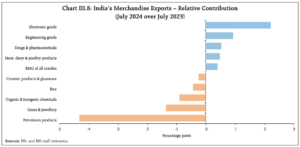

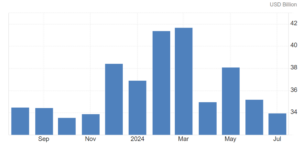

India’s exports contract 1.5% to $34 bn in July 2024

Launched nearly a decade ago, the IES Scheme seeks to reduce the financial burden on exporters by offering loans at lower interest rates, with the government compensating banks for the differential. Initially targeted at Micro, Small, and Medium Enterprises and labour-intensive sectors, the scheme has been extended multiple times, most recently until August 31, 2024, for MSME exporters.

The department of commerce is in favour of a five-year extension of IES, encompassing both MSMEs and non-MSMEs, to ensure broader coverage. This extension is seen as essential for maintaining the competitive edge of Indian exporters in the global market.

EPCG scheme and compliance needs

The Export Promotion Capital Goods (EPCG) scheme allows exporters to import capital goods at zero duty for manufacturing exportable products. The scheme has been simplified to reduce transaction costs, promote automation, and expedite service delivery, reflecting the government’s commitment to creating a more business-friendly environment.

Recent changes include an extension for submitting installation certificates for imported capital goods and a reduced, uniform composition fee for extending the export obligation period. These adjustments are aimed at alleviating compliance pressure on businesses and encouraging smoother operations.

Specialised export promotion schemes

The Advance Authorisation Scheme (AAS) facilitates the duty-free import of raw materials required for producing exportable goods. Unlike the EPCG scheme, AAS is focused on raw materials rather than capital goods. Exporters are required to achieve a minimum value addition of 15% and fulfil export obligations within 18 months. The scheme is particularly beneficial for industries that rely heavily on imported inputs.

The Duty-Free Import Authorisation (DFIA) scheme, a post-export initiative, permits duty-free import of raw materials after the export of finished goods. Unlike AAS, the DFIA is transferable, allowing more flexibility for exporters. However, it is limited to items listed under the Standard Input-Output Norms (SION).

Sector-specific incentives

Targeted specifically at the textiles sector, the RoSCTL scheme refunds various central and state taxes, including VAT on fuel and electricity duty, making Indian textile products more competitive internationally. Despite flat growth in textile exports, the scheme has seen a 10% budget enhancement, with unutilised funds potentially supporting other schemes like RODTEP.

Launched in 2019, the Transport and Marketing Assistance (TMA) scheme subsidises freight costs for agricultural export products, ensuring that Indian agricultural goods remain competitive in global markets. The scheme covers a wide range of products, excluding specific items listed under Chapters 1 to 24 of the ITC HS code.

As the government deliberates on extending and enhancing export promotion schemes like RODTEP and IES, the stakes for India’s export sector have never been higher. The outcome of these discussions will not only determine the immediate financial relief available to exporters but also shape the long-term strategy for navigating the complexities of global trade.

With potential reallocations of funds and adjustments to current policies on the table, the government’s approach will be crucial in ensuring that Indian exporters remain competitive and resilient in an increasingly challenging global market. Moreover, the proactive measures being considered, such as redirecting unutilised funds from schemes like ROSCTL, reveal the importance of these export promotion schemes in maintaining momentum in the export sector. The decisions made now could pave the way for a more robust export framework, supporting India’s growth ambitions in the face of ongoing international uncertainties.