Impact of MFN clause suspension: The suspension of the most favoured nation clause by Switzerland under the double tax avoidance agreement with India marks a significant development in international taxation. From January 1, 2025, Swiss authorities will double the withholding tax rate on dividends paid to Indian tax residents from 5% to 10%. This change, stemming from a 2023 ruling by the Indian Supreme Court, poses challenges for Indian businesses operating in Switzerland and highlights the need for India to revisit its approach to international tax treaties.

The MFN clause, integral to many international treaties, ensures that a signatory country treats all its partners equally in trade or taxation matters. If a country offers favourable terms to one partner, those benefits must extend to all others under the treaty. In the context of the India-Switzerland DTAA, this clause had allowed Indian entities to benefit from a reduced withholding tax rate of 5%, mirroring the rate extended by Switzerland to countries like Colombia and Lithuania after they joined the OECD.

However, the Indian Supreme Court ruled that such benefits could not automatically apply without formal notification under Indian law. This ruling led Switzerland to reconsider its unilateral application of the MFN clause, resulting in the decision to revert to the original 10% withholding tax rate.

READ I Double trouble: Steel industry face rising imports, emissions

Causes of MFN clause suspension

The roots of the suspension lie in the 2023 Supreme Court ruling, which clarified that the MFN clause could only apply to countries that were OECD members at the time the DTAA was signed in 1994. Countries like Colombia and Lithuania, which joined the OECD later, were therefore excluded from the MFN benefits as per the court’s interpretation.

Switzerland’s position is that the MFN clause should apply automatically, allowing reduced rates based on benefits extended to other countries, but the court’s ruling emphasised the need for explicit notification under Indian law. Viewing this lack of reciprocity as a breach, Switzerland opted to reinstate the original 10% withholding tax rate.

For Indian companies operating in Switzerland, this suspension represents a significant shift. Firms in high-growth sectors like financial services, pharmaceuticals, and IT will face increased tax liabilities, diminishing their competitiveness relative to businesses from other countries that continue to benefit from MFN provisions. This development reflects a broader trend where unresolved ambiguities in treaty language lead to challenges in interpretation and implementation.

Implications for Indian Economy

The reversion to a 10% withholding tax rate will impose higher tax burdens on Indian businesses operating in Switzerland. Previously, Indian companies benefited from a reduced tax rate of 5% on dividends, which not only lowered their financial outlays but also enhanced their competitiveness. The increased rate will now add to operational costs, potentially discouraging investments in Switzerland and impacting sectors where Indian firms have established strongholds. This move could further exacerbate the challenges faced by Indian firms competing with companies from nations that continue to enjoy MFN benefits.

The MFN clause suspension also sets a precedent that could influence India’s agreements with other nations. The Swiss decision highlights how differing interpretations of MFN provisions can lead to disputes. If similar disagreements arise with other treaty partners, Indian businesses could face additional hurdles in their international operations. The lack of clarity in treaty frameworks could deter outbound investments, creating an atmosphere of uncertainty for Indian enterprises expanding abroad.

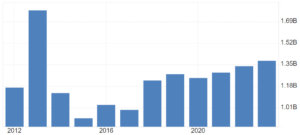

Indian exports to Switzerland

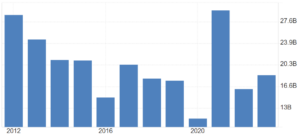

India’s imports from Switzerland

Another significant concern is the potential for double taxation. Many DTAA provisions, such as those in the India-Australia agreement, suffer from imprecise language. Disputes over income classification—whether payments are categorised as royalties or business income—can lead to compliance challenges and higher tax burdens. Without a streamlined approach to resolving such issues, Indian businesses risk facing undue financial strain and administrative complexities.

Learnings for India’s policymakers

The MFN clause suspension by Switzerland underscores the need for India to adopt a more strategic and proactive approach to international tax treaties. Policymakers must prioritise clarity and mutual agreement in treaty provisions to avoid ambiguities that could lead to adverse outcomes for Indian businesses. Proactive negotiations with treaty partners are essential to harmonise interpretations of critical clauses like MFN and to ensure that agreements reflect modern business realities, particularly in digital and service sectors.

A key takeaway is the importance of aligning treaty provisions with domestic legal frameworks. The Supreme Court’s ruling emphasised that international agreements must be explicitly notified under Indian law to be enforceable. Policymakers should work towards integrating international tax obligations into the domestic legal system to avoid conflicts and ensure smoother implementation.

Furthermore, enhancing the capacity of India’s trade and tax negotiators is crucial. By prioritising reciprocity and fairness in agreements, negotiators can safeguard Indian businesses from unilateral actions by treaty partners. This requires a thorough understanding of global economic trends and the evolving needs of Indian businesses in a competitive international landscape.

India must also modernise its treaty frameworks to address the unique challenges posed by contemporary business practices, including digital transactions and cross-border services. By ensuring that treaties are tailored to current and future business realities, India can foster an environment conducive to attracting investments and boosting economic growth.

The MFN clause suspension by Switzerland is a significant moment for India’s international taxation policy. It highlights the challenges posed by ambiguous treaty provisions and underscores the importance of a cohesive and forward-looking approach to bilateral agreements. While the immediate impact includes higher tax burdens and reduced competitiveness for Indian firms in Switzerland, the broader implications point to the need for India to revisit its treaty frameworks comprehensively.

Policymakers must act swiftly to mitigate the short-term impacts of the MFN clause suspension while focusing on long-term reforms to enhance India’s global economic competitiveness. By addressing ambiguities, aligning international agreements with domestic laws, and modernising treaty provisions, India can protect its businesses from adverse outcomes and build a resilient and equitable framework for international trade and taxation.