Future of NFT regulation: The world witnessed an unprecedented craze for non-fungible tokens, better known as NFTs, last year. Brands and creators from diverse industries clamoured to seize the opportunities presented by this digital phenomenon. The NFT industry once dominated headlines, generating billions in trading volume, but it seems the fervour has cooled.

Reports indicate that NFT trading volume reached a staggering $24.7 billion in 2022, following a robust $11.7 billion in 2021. However, a recent analysis by Dune Analytics tells a different story, with NFT trading volume plummeting from $17 billion in January to a mere $466 million by September. As India navigates its own path in regulating NFTs, it must strike a balance between fostering innovation and ensuring investor protection.

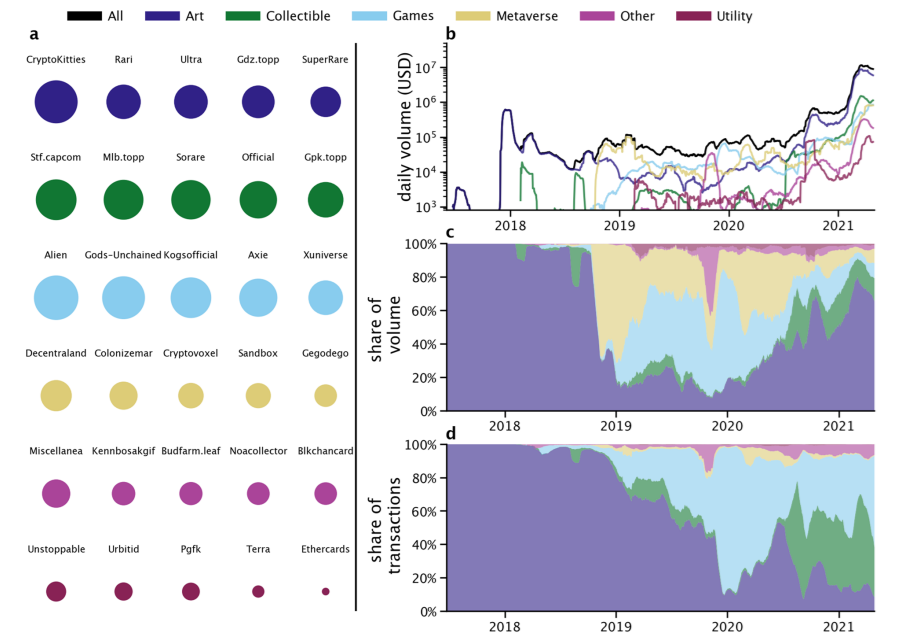

Description of the NFT landscape

NFTs, or non-fungible tokens, are unique digital assets that exist on blockchain technology, serving as irreplaceable proof of ownership and authenticity for both digital and physical items. Unlike cryptocurrencies like Bitcoin, which are fungible and interchangeable, NFTs are one-of-a-kind, making them ideal for representing digital collectibles, art, music, virtual real estate, and much more. NFTs offer creators and collectors a new way to connect, trade, and establish ownership in the digital realm, underpinned by decentralised, secure, and transparent records of transactions on the blockchain. Their rise has transformed the way we perceive and value digital assets, sparking a revolution in various industries.

READ I Explained: India’s struggle to eradicate multi-dimensional poverty

Challenges to NFT regulation

The regulatory landscape for NFTs in India mirrors the global trend, with policymakers and regulators struggling to establish frameworks that can effectively safeguard investors while fostering innovation in the digital asset space.

Data hosting and storage of NFTs

NFTs rely on blockchain technology for proof of ownership and authenticity. However, the separation of NFTs and the digital assets they represent raises concerns about data hosting and storage. If the digital asset is deleted or lost, the NFT’s value may be compromised, and there are currently no clear legal rights for NFT owners in such cases. Indian regulators must address this challenge by formulating clear guidelines on data protection and recovery mechanisms.

NFT royalties

NFTs offer creators the ability to receive royalties each time their artwork is resold. However, the lack of standardisation across platforms and variations in recognition of resale rights in different countries pose challenges for ensuring automatic royalty payments in India. Establishing a standardised royalty framework and addressing legal gaps in intellectual property rights is essential for the Indian NFT ecosystem to thrive.

Data protection

NFTs can contain personal information, raising concerns related to data protection laws. Given that blockchain does not allow for data erasure or amendment, India must find ways to reconcile security and data-sharing concerns, protecting the privacy of NFT users while complying with data protection regulations.

Intellectual property rights

The misconception that NFT ownership equates to copyright ownership can lead to legal disputes. India needs to clarify the rights associated with NFT ownership, ensuring creators retain their intellectual property rights while preventing potential conflicts.

Transacting NFT sales

Navigating the legal requirements of consumer protection laws in India is vital for NFT sales. Additionally, addressing disputes related to ownership and authenticity, especially in cross-border transactions with varying legal requirements, will be crucial.

NFT taxation

Taxation of NFTs in India remains uncertain, with no specific legislation or official guidance in place. Determining the applicable taxes, including capital gains and inheritance tax, is vital, and the jurisdiction of the digital asset’s location adds complexity to the issue.

NFTs: Regulatory updates

India should take cues from recent global regulatory actions when shaping its NFT regulatory framework. The Financial Action Task Force’s (FATF) updated guidance emphasises the importance of a risk-based approach to regulating NFTs, particularly when used for payment or investment purposes. India must adopt a similar approach to effectively manage potential risks.

Recognising NFTs as potential money services businesses (MSBs) in India, similar to what the U.S. Department of Treasury has done, can help combat money laundering and terrorist financing concerns associated with peer-to-peer NFT transactions.

India can draw inspiration from the Monetary Authority of Singapore’s stance, which monitors the NFT space and is ready to implement regulatory measures if necessary. This proactive approach can help India navigate the evolving NFT landscape effectively. India should closely monitor legal cases involving NFT platforms worldwide to gain insights into potential classification issues, disclosure regulations, and the need for legal clarity within its own jurisdiction.

Future of NFTs in India

As India charts its course in regulating NFTs, it faces key policy challenges that require careful consideration. Balancing innovation with market integrity is vital. India must implement financial regulations that protect brands and consumers, prevent fraud, enhance transparency, and promote fair trading practices within the NFT ecosystem.

India should establish mechanisms to protect and enforce intellectual property rights within the NFT space, ensuring creators are fairly compensated and incentivized for further innovation. Clear guidelines and standards for disclosure and dispute resolution are essential to safeguard Indian consumers in NFT transactions. Educating buyers about their rights and risks is crucial to prevent scams and fraudulent activities.

India should strike a balance between privacy protection and compliance regulations, establishing content moderation guidelines to prevent scams within the NFT ecosystem.

NFTs hold great promise in India, but it also demands a well-crafted regulatory framework that balances innovation and investor protection. As NFTs gain mainstream recognition and adoption, India must remain proactive, adapt to evolving regulatory requirements, and ensure the integrity and stability of its NFT market. By doing so, India can foster a secure and transparent NFT ecosystem that benefits creators, investors, and consumers alike while contributing to the global evolution of this dynamic digital asset class.