The recent decision of the GST Council to impose the highest tax slab on the online gaming industry has sparked nationwide debates and discussions. While some view this as a potential burden on a booming sector, many argue that it is a well-considered move for several compelling reasons.

The online gaming industry has witnessed extraordinary growth, evolving into a multi-billion dollar market. Given its lucrative nature, it comes as no surprise that the government has turned its attention to this thriving sunrise industry. With the decision, the government is projected to collect over Rs 17,000 crore in indirect taxes from this sector, a substantial revenue stream to support various developmental initiatives and welfare programs.

SURVEY: Should India offer PLI scheme in chemicals and petrochem industry?

Supporters of the decision assert that it establishes parity between online gaming and other entertainment avenues like cinema and amusement parks, which have long been subject to similar tax rates. Treating online gaming on par with these traditional forms of entertainment ensures fairness and prevents market distortions.

Moreover, the decision addresses concerns related to addiction and its impact on the younger generation. By imposing a higher tax rate, the government aims to discourage excessive gaming behavior. However, critics point out that similar efforts in curbing alcohol and tobacco consumption have had limited success. More research and awareness efforts may be needed to effectively address addiction issues.

A survey was conducted by Policy Circle sought and the Centre for Innovation in Public Policy on the decision to impose the highest GST slab on the online gaming industry. The survey looked to gauge public sentiment towards this tax measure and its potential impact on the sector.

READ I Residential segregation: The impact of India’s hidden divide

Survey on taxing online gaming industry

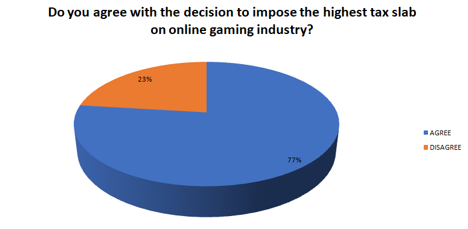

The survey revealed a divided sentiment among respondents regarding the imposition of the highest tax slab on the online gaming industry. While approximately 100 respondents (out of 130) expressed agreement with the tax measure, 30 respondents disagreed, indicating a significant level of support for the taxation policy.

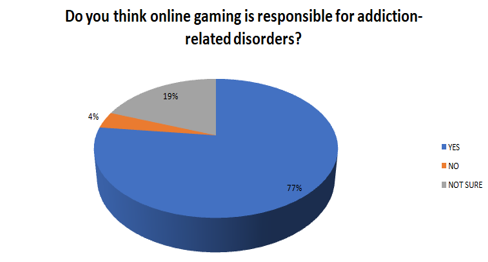

Regarding the perception of online gaming’s association with addiction-related disorders, a majority of 100 respondents believed online gaming to be responsible for addiction-related issues, while only 5 respondents disagreed. However, 25 respondents remained unsure, highlighting the need for further research and awareness on this topic.

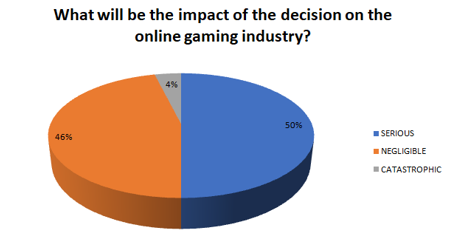

When assessing the potential impact of the taxation decision on the industry, respondents’ opinions varied. Approximately 65 respondents believed the impact would be serious, while 60 respondents considered it negligible. Interestingly, only 5 respondents anticipated a catastrophic impact, suggesting a sense of optimism among the majority.

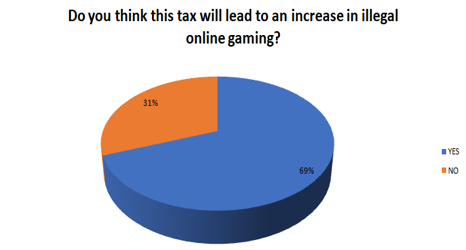

Respondents were also asked if they believed the new tax measure would lead to an increase in illegal online gaming activities. Survey results indicated that 90 respondents believed the tax could indeed contribute to such practices, while 40 respondents disagreed.

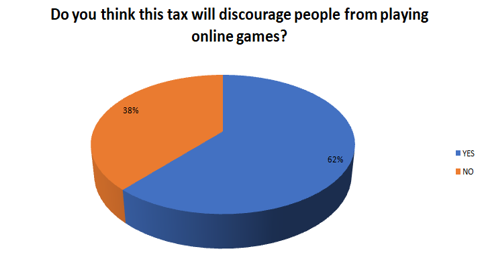

Furthermore, the survey probed the potential effect of the tax on player behavior. When asked if they thought the tax would discourage people from playing online games, 80 respondents agreed with this notion, while 50 respondents disagreed, revealing concerns about its impact on player engagement in the industry.

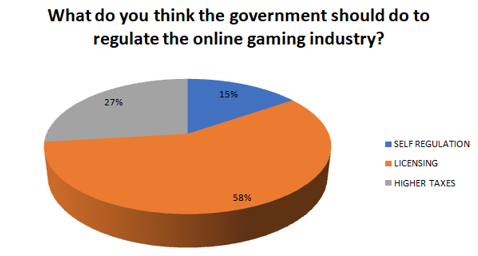

As for regulating the online gaming industry, participants favored licensing as a regulatory approach, with 75 respondents expressing this preference. In contrast, 35 respondents suggested higher taxes as a means of regulation. Surprisingly, only 20 respondents advocated for self-regulation, indicating limited trust in the industry’s ability to regulate itself effectively.

While public sentiment appears to be in favor of higher tax rates for the online gaming industry, critics argue that such measures could stifle the sector’s growth and dampen investor enthusiasm. They acknowledge that responsible regulation and taxation are essential but caution that taxing online gaming on par with gambling might drive gamers to illegal portals both within and outside the country.

The GST Council’s decision to impose the highest tax slab on the online gaming industry is a bold step towards revenue generation. However, it warrants a careful balance between regulation and growth, considering the industry’s immense potential. As the sector continues to evolve, collaborative efforts among stakeholders are vital to fostering a sustainable and responsible gaming landscape that benefits both players and the nation as a whole. Striking this balance will determine the future trajectory of online gaming in India.

(AI tools were used to edit this story.)