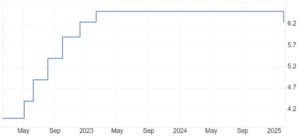

The Reserve Bank of India has announced a 25 basis point repo rate cut on February 7, marking the first cut in nearly five years. The widely anticipated decision to lower the key policy rate to 6.25% comes amid a slowing economy and persistent inflation concerns. RBI Governor Sanjay Malhotra’s maiden policy decision reflects a balancing act between spurring economic growth and maintaining price stability. However, markets responded with disappointment, citing a lack of additional liquidity measures and a neutral policy stance.

The Indian economy is projected to grow at 6.4% in the current fiscal year, the slowest in four years, necessitating monetary policy support. While inflation has moderated to 5.2%, it remains above the RBI’s target of 4%. The rate cut signals the central bank’s shift towards reviving growth, aligning it with those central banks that have prioritised economic expansion over currency stability.

READ I Trump’s tariffs could backfire on the US

More repo rate cuts likely

Weak consumption demand continues to be a pressing concern. Urban consumption remains sluggish, as evidenced by disappointing earnings from consumer goods companies like Hindustan Unilever and Nestlé India. The rupee’s depreciation has also added to economic uncertainties. The currency has weakened by over 2% this year, reaching a record low of 87.48 against the dollar. While the RBI continues to intervene in foreign exchange markets to manage volatility, excessive currency fluctuations pose additional risks to the economy. The central bank’s liquidity injection measures have also played a crucial role. Prior to the rate cut, the RBI infused Rs 1.5 lakh crore into money markets to stabilise borrowing costs, which signalled that monetary easing was on the horizon.

RBI’s first rate cut in 5 years (figures in %)

Despite the expected rate cut, market reactions were muted. The NSE Nifty 50 fell by 0.2%, and bond yields rose by 5 basis points to 6.71%, indicating investor concerns over the central bank’s lack of further liquidity measures. The RBI opted to retain its neutral stance instead of shifting to an accommodative stance, signalling caution on future rate cuts. While the rate cut is a step in the right direction, it may not be sufficient to stimulate demand without additional measures. The RBI might implement two more 25 bps cuts this year, but global headwinds could limit the easing cycle.

The housing market is likely to benefit from the rate cut, as lower interest rates could make home loans more affordable, thereby boosting demand, particularly in the under-Rs 50 lakh segment. The auto industry is also expected to see an uptick in demand, as cheaper loans may encourage consumer spending on passenger and two-wheeler vehicles. However, the impact on banking and financial services remains uncertain. While the rate cut should improve credit flow, banking stocks reacted negatively due to the absence of clear measures on liquidity support.

Falling rupee and rising inflation

The rupee’s continued depreciation remains a concern. RBI Governor Malhotra reiterated that foreign exchange interventions are aimed at curbing excessive volatility rather than defending a particular level. However, a weaker rupee could exert upward pressure on inflation, limiting the scope for aggressive rate cuts in the future.

Dollar vs rupee exchange rate

Inflation, while easing, remains above the central bank’s target. The RBI expects consumer price inflation to moderate to 4.2% in the next fiscal year, aided by good kharif production and winter easing of vegetable prices. However, global factors such as trade policy uncertainties and adverse weather events could pose risks.

Measured easing amid global uncertainty

The RBI’s decision to maintain a neutral stance suggests that further rate cuts will depend on evolving macroeconomic conditions. While monetary policy has started tilting towards growth, fiscal policy support, such as recent tax cuts, will also play a crucial role in shaping economic recovery.

Given the mixed market response and external uncertainties, the central bank will need to monitor liquidity conditions closely. Further rate cuts could be on the horizon, but the RBI is likely to tread cautiously to avoid excessive currency depreciation and inflationary pressures.

The RBI’s latest monetary policy decision reflects a shift towards growth support while maintaining vigilance on inflation. The 25 bps rate cut aligns with market expectations but has not provided a significant boost to sentiment. With the rupee under pressure and global risks looming, the central bank’s cautious approach underscores the complexity of managing India’s economic recovery in an uncertain environment. Whether further rate cuts materialise will depend on the interplay between growth momentum, inflation trends, and external economic conditions.