SMEC policy for electric vehicles: The government is in the final stages of drafting guidelines for promoting the manufacturing of electric passenger vehicles in India, as it looks to benefit from the global shift towards sustainable mobility. A critical focus for the ministry of heavy industries will be calibrating import tariffs on electric vehicle components in a way that makes India attractive to global players.

Countries such as China, the United States, and members of the European Union are leading the transition to EVs. India, with its vast market potential and manufacturing capabilities, must position itself to join this global race. While India is already a significant consumer of EVs due to its large population, it has yet to crack the formula for becoming a global hub for EV manufacturing, sales, and exports. International examples suggest that substantial investments, ambitious policies, and rapid infrastructure development could be the way forward.

READ | India’s GDP growth prospects face global turbulence

Supply chain challenge

Despite its ambitious goals, India lacks a self-reliant electric vehicles ecosystem and remains vulnerable to global supply chain disruptions. For instance, in January, China imposed restrictions on the export of key inputs and machinery, leaving Indian firms in the electronics, solar, and EV sectors scrambling. India’s dependence on Chinese machinery, intermediate goods, and components is a pressing concern — one shared by many countries including ASEAN members which rely on Chinese inputs for their manufacturing needs. The only way to reduce such vulnerabilities seems to be building local manufacturing capabilities and diversifying supply chains.

One of the most important areas in EV manufacturing is battery production, which constitutes a significant portion of a vehicle’s cost. Setting up domestic giga factories, modelled on global leaders like Tesla, or encouraging joint ventures with foreign firms can reduce import dependency and bring down costs. Government incentives such as tax breaks, land subsidies, and low-interest loans could further attract investments into this critical sector. Additionally, localising the production of EV components such as motors, power electronics, and charging equipment is crucial.

SMEC Scheme highlights

The Scheme to Promote the Manufacturing of Electric Passenger Cars in India (SMEC), announced in March 2023, seeks to attract investments from leading global EV manufacturers and establish India as a major hub for EV production. Final guidelines are expected within a month, following inter-ministerial consultations. Industry stakeholders, including original equipment manufacturers (OEMs) and the Society of Indian Automobile Manufacturers (SIAM), are part of the ongoing discussions.

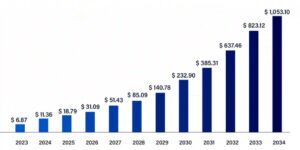

India electric vehicles market size in USD billion

Tesla CEO Elon Musk has shown a consistent interest in entering the Indian EV market. However, the company has requested significant cuts in India’s import duties on completely built units before committing to local manufacturing.

A major component of the SMEC policy is a proposal to slash import duties on high-end EVs (priced above $35,000, including cost, insurance, and freight) to 15%, down from the current 70-100%, provided manufacturers meet minimum investment and domestic value addition (DVA) requirements.

Incentivising local manufacturing

Under SMEC, manufacturers must invest a minimum of Rs 4,150 crore and achieve DVA targets of 25% by year three and 50% by year five. These thresholds may be progressively increased to deepen localisation, making Indian-manufactured EVs more affordable and export-competitive. In alignment with the production-linked incentive (PLI) scheme for automobiles and components, the SMEC guidelines may also count R&D and EV charging infrastructure spending as eligible investments.

While SMEC targets manufacturers through reduced import duties and investment incentives, India must also support demand through consumer-focused policies. Scaling up existing tax rebates, purchase subsidies, and reduced registration fees across states can significantly boost domestic adoption.

Building demand and export potential

India should follow Europe’s lead by introducing stricter emission standards and setting clear timelines for phasing out internal combustion engine vehicles. This could provide a much-needed policy nudge to automakers. For boosting exports, tax credits or per-unit export subsidies, coupled with trade agreements with EV-enthusiastic markets like the EU, could position India as a global supplier.

In addition, India must encourage technology transfer through joint ventures with global firms like Tesla. China’s success offers a useful blueprint: Beijing pursued strategic partnerships that balanced foreign investment with knowledge-sharing, which accelerated its domestic capabilities. India should also strengthen its partnerships with countries like Japan and South Korea to access high-quality components and reduce its over-dependence on China.

A significant roadblock to electric vehicle adoption in India remains the high cost of electric vehicles. The nation must strive to reach cost parity with ICE vehicles through localised production, economies of scale, and battery innovation. Global leaders have already made headway in these areas. The US and European markets went a step further by launching consumer awareness campaigns to dispel myths about EV range, charging infrastructure, and resale value—efforts that have paid off and offer valuable lessons for India.