With NBFCs under scrutiny, the RBI seeks to ensure supply chain finance remains a lifeline for MSMEs without compromising financial stability. #NBFC #supplychainfinance #MSME Read more »

In the face of a dramatic decline in loan sanctions, NBFCs are knocking the doors of the RBI for permission to take deposits. #NBFCs #shadowbanks #RBI Read more »

#NBFCs are catalysts of financial transformation, and their regulation holds the key to economic growth with stability. #RBI #sebi #finmin Read more »

Effective regulation of shadow banks is imperative to promote stability while harnessing the potential of India's non-bank financial sector, says Shyamala Gopinath. #nbfcs #rbi #npas Read more »

India needs these fiscal, monetary and financial policy adjustments to stay afloat in the global economic crisis triggered by the new coronavirus pandemic. Read more »

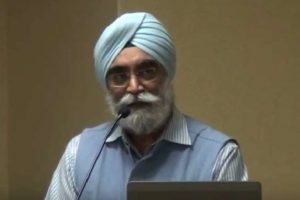

The government and the RBI have taken some useful steps, but the situation warrants bolder measures like the ones initiated by the US and UK, says Dr Charan Singh. Read more »