Surviving Trump’s tariff war: By any metric, a trade war involving tariffs exceeding 100% is a scorched-earth policy. It is neither tactical nor temporary—it is strategic punishment. And yet, in the crucible of a spiralling tariff war ignited by Donald Trump’s doctrine of economic nationalism, Beijing seems remarkably composed. How does one explain China’s resilience when faced with a 145% tariff wall on its exports to the United States?

There are three dimensions to this story: the arithmetic of economics, the politics of leadership, and the psychology of endurance.

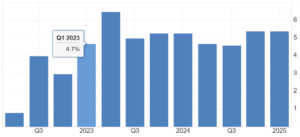

China annual GDP growth rate (%)

Despite the hammer of tariffs, China’s economy expanded by 5.4% in the January-March quarter, buoyed by a 12% surge in exports in March. Sceptics will rightly point out that this was a case of front-loading—exporters racing to ship goods before the punitive tariffs hit. But there is more beneath the surface. The share of Chinese exports going to the United States has dropped from over 19% to less than 15% in five years. That trend—of slow decoupling—did not begin with Trump. It began with Xi Jinping’s pivot to reduce dependence on the West.

READ I Kirana stores struggle amid digital tsunami

The arithmetic: Export slowdown, strategic diversification

At trade fairs and summits in Southeast Asia, China is vigorously wooing new markets—Vietnam, Malaysia, Cambodia—emphasising the size and depth of its domestic market, its skilled manufacturing base, and its commitment to trade. The symbolic message from Beijing is unmistakable: the world is larger than Washington.

Tariffs may slow growth temporarily, but Sheng Laiyun of the National Bureau of Statistics has good reason to be confident when he says China has the “resilience and great potential” to weather external shocks. The underlying structural shift—China’s growing strength in electric vehicles, robotics, and industrial equipment—has already taken root. Output of new energy vehicles rose by 45.4% in the last quarter, while production of 3D printers and industrial robots rose by 45% and 26%, respectively.

The politics: Xi’s long game vs Trump’s impulses

Here lies the sharpest contrast. In Washington, confusion reigns. There are carve-outs on smartphones one day, and contradictory statements the next. Tariffs are raised to 145% on Chinese goods while simultaneously paused for dozens of other countries. President Trump’s White House scrambles to spin these U-turns as strategy, but the markets and businesses that bear the brunt are unconvinced.

Contrast this with Beijing’s steadiness. Xi Jinping does not need to run for re-election. He has no need to placate midwestern farmers or Wall Street. His constituency is ideological—national rejuvenation, not quarterly earnings. This makes him structurally capable of bearing more economic pain than his American counterpart.

Indeed, the trade war offers Xi a convenient external villain. In speeches and propaganda, the Chinese state has painted Trump’s tariffs as a symbol of Western hostility—confirmation of China’s long-standing warnings that America seeks to contain its rise. This narrative has been internalised, turning economic adversity into a test of patriotism.

The People’s Daily likens Washington to pirates. Foreign ministry spokespersons invoke Mao Zedong and the Korean War. And Xi himself has leaned into the self-reliant ethos: “China has never relied on anyone’s gifts and is unafraid of any unreasonable suppression.” For domestic consumption, Trump’s tariffs are not an economic calamity—they are a call to national resolve.

The psychology: Factories may bend, but do not break

At the factory floor, however, the story is more textured. The small manufacturers of Guangzhou are hurting—cancelled orders, unsold inventories, and temporarily shuttered workshops are real consequences. But it is worth noting that most are not collapsing; they are adapting. Some are pivoting to domestic markets, others to Southeast Asia. Factory owners, scarred by cycles of boom and bust, display an unshaken faith in eventual recovery.

As one said with quiet defiance: “Personally, I am quite satisfied and have great confidence in China.”

Why? Because while American businesses like Learning Resources are being “asphyxiated” by their own government’s tariffs, Chinese factories enjoy cost structures and scale that are hard to displace. In some categories—like low-cost cooking equipment—China simply has no peer. Even with 125% tariffs, products remain competitive due to low base costs.

Moreover, China is not merely retaliating with tariffs. It is playing a sophisticated counter-strategy. Export controls on rare earths, new licensing restrictions on U.S. chipmakers, and the weaponisation of the “unreliable entities list” are asymmetric responses that hit critical American supply chains, from semiconductors to military hardware.

And for all of Trump’s bravado, there is no evidence of a coherent alternative supply chain being built at speed. Multinationals cannot relocate overnight. Hobby Lobby and other importers have paused shipments. Factory managers in China know this. Their gamble is that they can wait out the storm longer than Trump can keep whipping it up.

Trump’s tariff war: The risks for China

This is not to say China is unscathed. Consumer prices fell in the first quarter, indicating weak domestic demand. Real estate investment continues to decline. And the urban middle class, still nursing scars from the property bust and COVID-era lockdowns, may not be in the mood for another sacrifice.

The test for Xi is whether nationalist sentiment can outrun economic pain. The last time China tried to suppress popular discontent with nationalism—during the Zero-COVID protests—it came dangerously close to losing control. A similar risk looms now, especially if factory closures and layoffs begin to multiply.

Still, for now, the political calculus favours endurance.

Trump is playing poker with a pair of twos and trying to bluff his way through. Xi, on the other hand, is playing weiqi (Go)—patient, calculating, and content with incremental positional gains. If Trump blinks first, Xi wins not just the round but the narrative. He can tell his people—and the world—that China did not capitulate to pressure, that it upheld the principle of mutual respect and prevailed through fortitude.

In a war of attrition, the player with the deeper bench and steadier nerves usually triumphs. And in this trade war, for all the noise from Washington, it is Beijing that seems to have both.